Tax-Free forms are documents used for VAT refund purposes.

They can be provided to you by the government, stores and Tax-Free companies to process VAT refund claims.

A Tax-Free form can have 3 purposes:

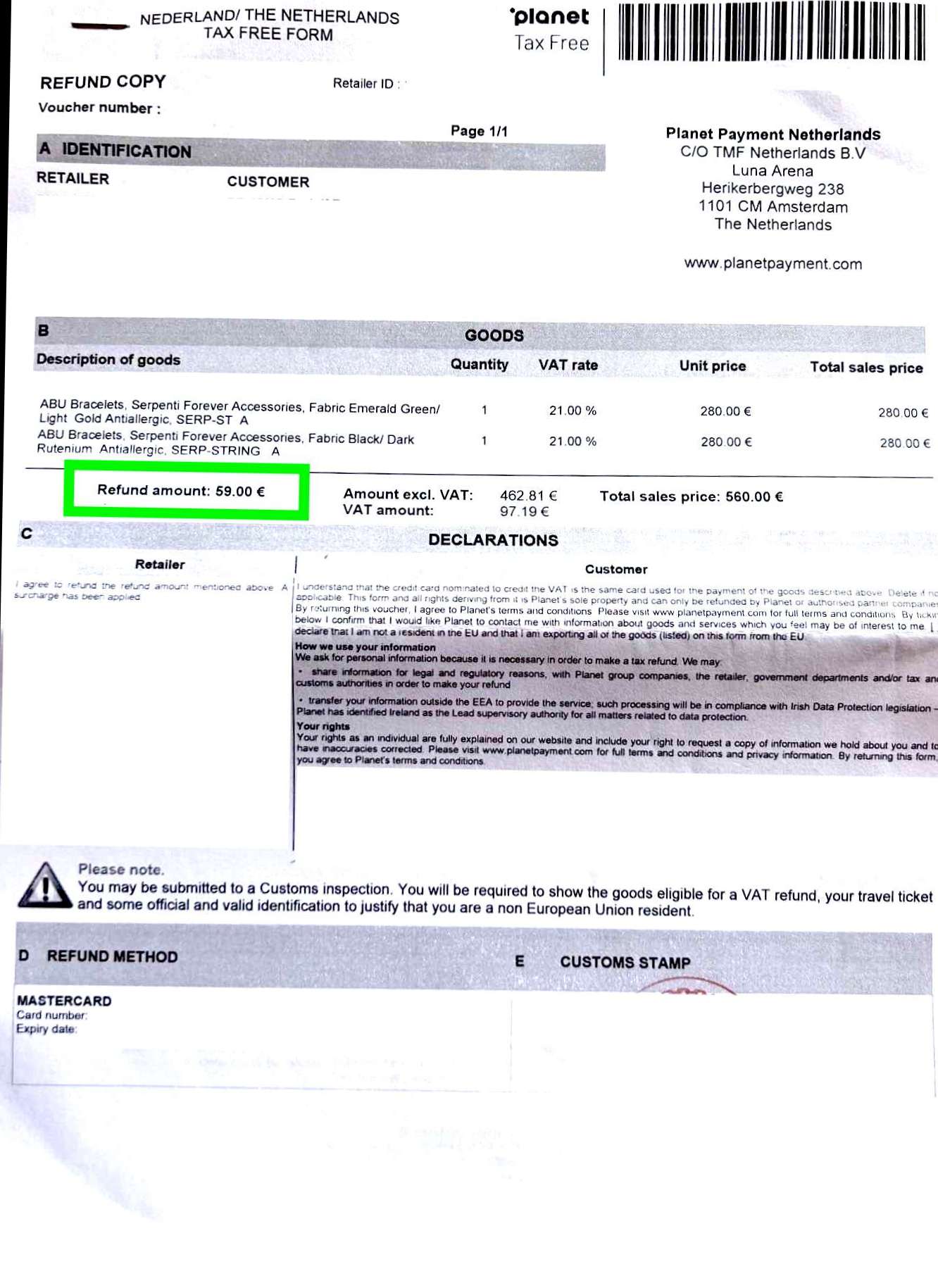

A Tax-Free form typically includes the same information as an official purchase invoice, plus details of the Tax-Free company if they issued the form:

Seller details

Tax-Free company details

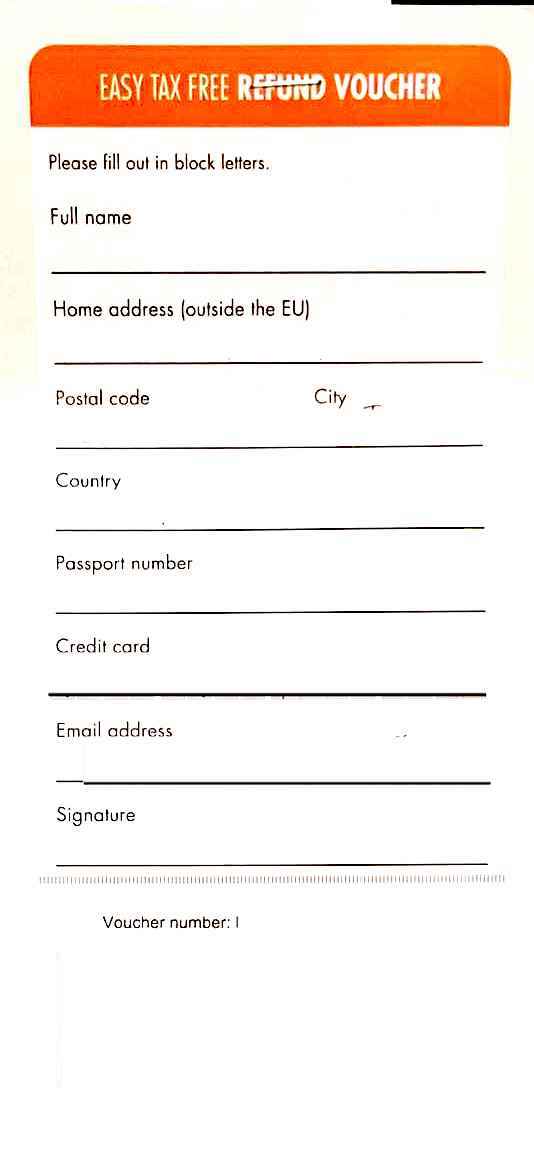

Buyer details (your name, non-EU address, passport number)

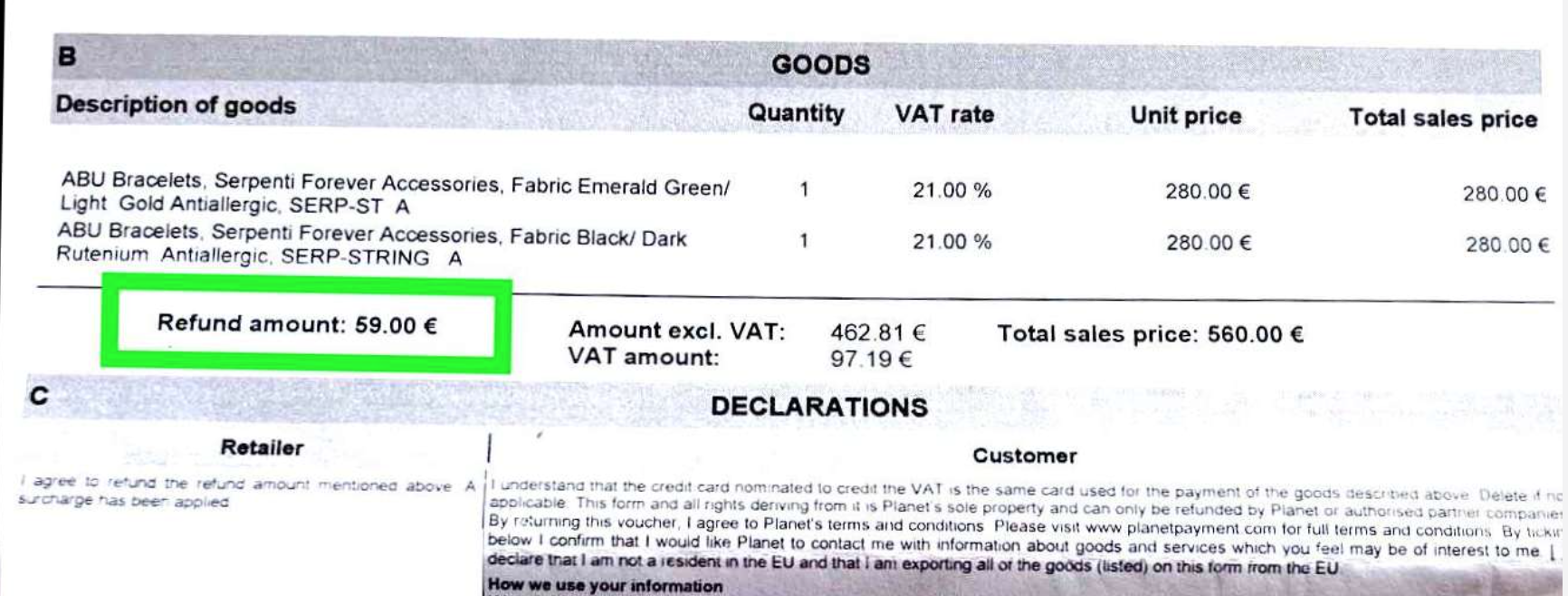

Description of purchased items

Value Added Tax (VAT) amount

Total purchase amount incl. VAT

Refund amount

Tax-Free company service fee (often in small print or not stated)

Did you know:

✅ In most EU countries it is not mandatory to have a Tax-Free form to be eligible for VAT refunds. A proper purchase invoice showing your name, non-EU billing address and passport number is sufficient.

✅ Tax-Free forms are often completed by the store at the moment of purchase.

✅ Tax-Free forms usually specify the exact refund amount for a specific purchase at a specific store.

✅ Tax-Free forms come in various shapes and sizes, ranging from regular A4 sheets to those resembling normal receipts, albeit usually longer.

✅ Customs departments throughout the EU accept Tax-Free forms as a replacement of an official purchase invoice from the store.

✅ Tax-Free forms can be submitted for cash refunds if the Tax-Free company mentioned on the form has a desk at the airport. In most cases there will be an extra fee charged for refunds in cash.

✅ In a few countries—like Italy, France and Spain— the Tax-Free form is mandatory for VAT refunds from local stores. Italian, French and Spanish stores must provide you with a Tax-Free form at the moment of purchase. Without it, you can not get proof of export from Customs. If you have receipts from stores in other EU countries, Customs will provide proof of export if you bring your own Tax-Free form.

Frequently Asked Questions:

Where can I find the Global Blue service fee?

Where can I find the Planet Payment Service fee?

Where can I find the Easy Tax Free service fee?

What is the Vatfree.com service fee?

What if I find a lower fee somewhere else?

How do Vatfree.com fees compare to other Tax-Free companies?

Names of Tax-Free companies issuing forms in the European Union are:

Vatfree.com

Global Blue

Planet / Premiere TaxFree

E-pay / Innova TaxFree

Easy Tax Free

Tax Free forms can look like this:

.jpg)