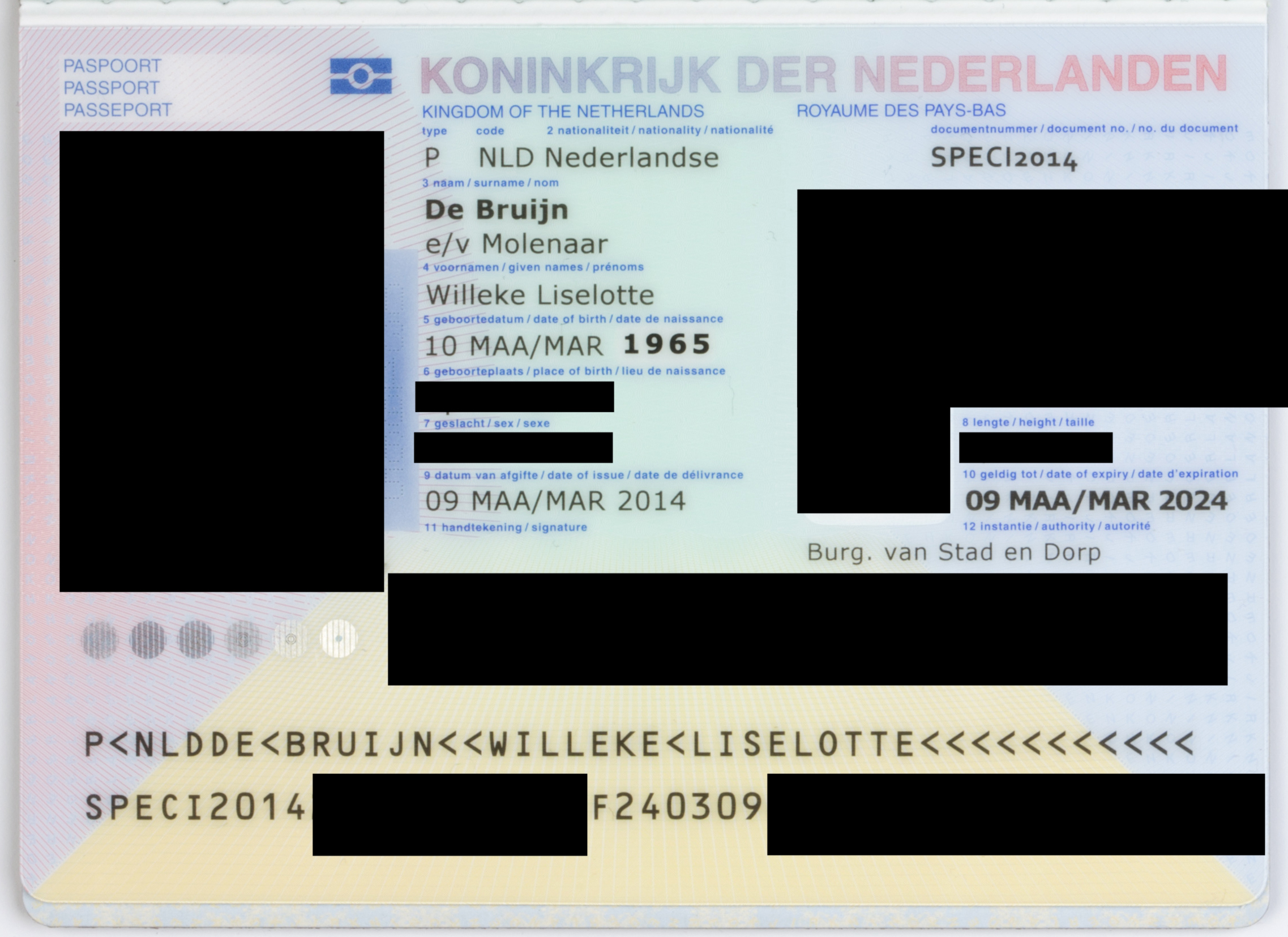

If you don't block your sensitive information yourself we will do it for you before saving the copy of your passport permanently to our system. We never share the original copy of your passport (these are deleted after blocking) and we only share the blocked versions of your documents if the retailer or tax administration requires them.

| Details you can block | place of birth, sex, height, social security number, photo, signature, name of spouse, profession, family members names, marital status |

| Details that should stay visible | passport number, name, date of birth, country, issue date, expiration date |

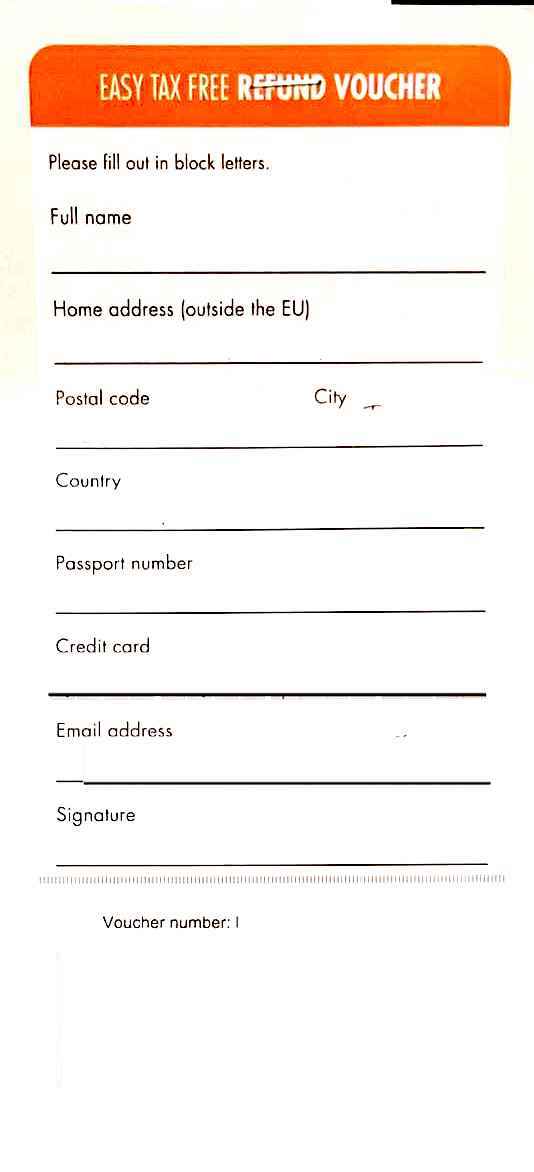

Example:

In all EU countries, items must be exported before the end of the 3rd month after the month of purchase.

After getting proof of export, the deadline for submitting a claim varies per country:

AU Austria 3 years / 1095 days

BE Belgium* 3 years / 1095 days

BG Bulgaria 5 years / 1825 days

CR Croatia 5 years / 1825 days

CY Cyprus 5 years / 1825 days

CZ Czech Rpblk 5 years / 1825 days

DE Germany 4 years / 1825 days

DK Denmark 1 year / 365 days

ES Spain 5 years / 1825 days

ET Estonia 5 years / 1825 days

FI Finland 5 months / 150 days

FR France 6 months / 180 days

GR Greece 90 days

HU Hungary 5 years / 1825 days

IR Ireland 5 years / 1825 days

IT Italy 3 months / 90 days

LI Lithuania 5 years / 1825 days

LU Luxembourg 5 years / 1825 days

LV Latvia 5 years / 1825 days

MT Malta 5 years / 1825 days

NL Netherlands 5 years / 1825 days

PL Poland 7 months / 210 days

PT Portugal 5 years / 1825 days

RO Roemania 5 years / 1825 days

SE Sweden 1 year / 365 days

SK Slovakia 5 years / 1825 days

SV Slovenia 5 years / 1825 days

UK United Kingdom 1 year / 365 days,

NOTE: all receipts/invoices from UK businesses issued after 1 January 2021 can no longer be submitted for a VAT refund. However, receipts/invoices from (web)retailers that have delivered outside the UK (via ocean freighter or courier) can still be submitted. Read More

*Stamped receipts for purchases made in Belgium are valid until December 31st of the third year after purchase date.

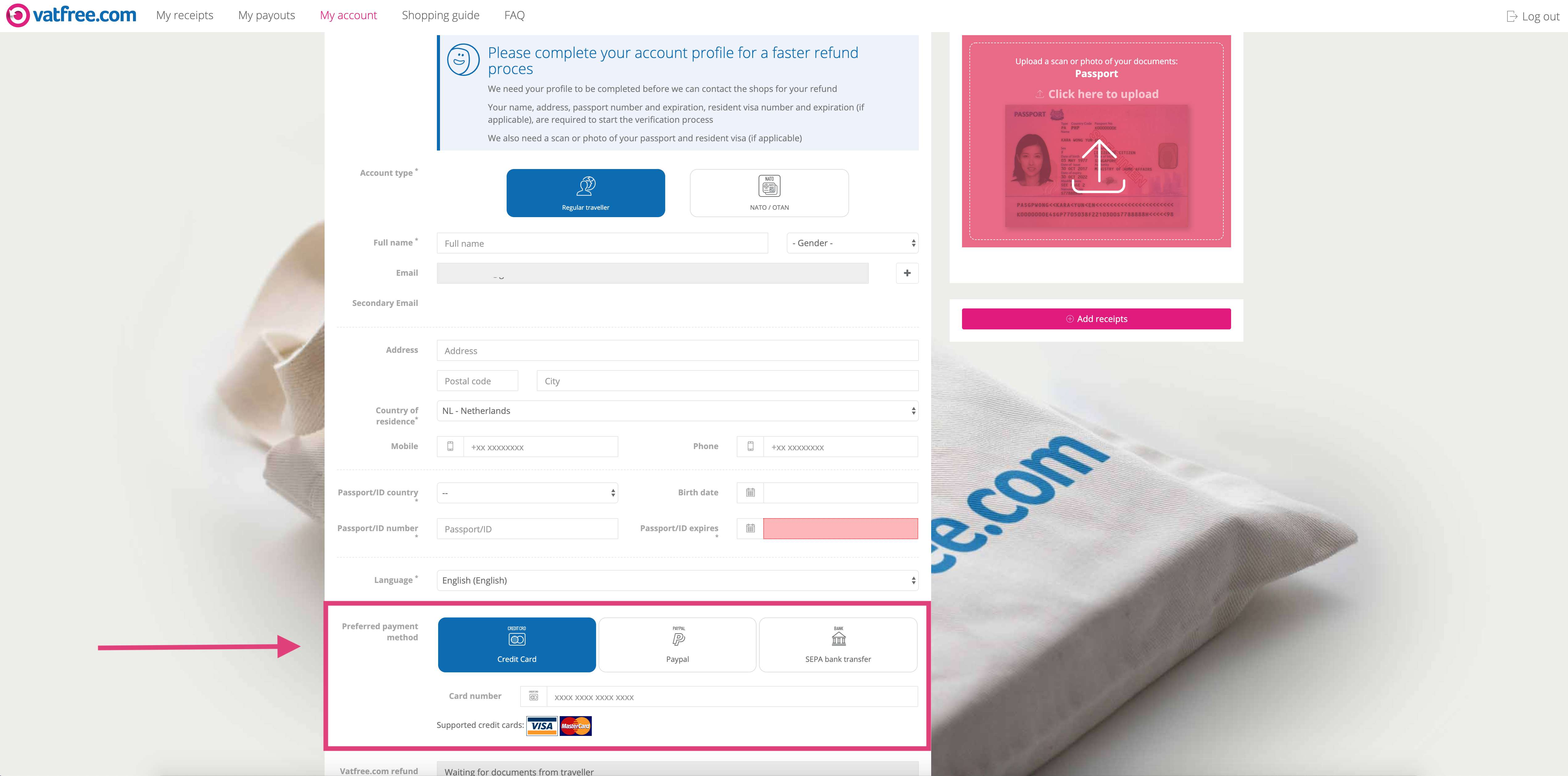

Where can I submit my payment details? /

You can submit you payment details in your account.

After you have submitted your payment details, we'll ask you to confirm them again when you submit a payment request. find out how to request payment here.

Yes, you can submit claims for items bought online.

There are different online shopping and delivery situations that will determine which procedures you must follow to claim back the VAT:

Don't worry! In most cases you don't need to send original documents by post.

As an exception, we might ask for your originals if:

Your receipt status will show wether you need to send originals by post.

Our address for postal mail can be found here.

If you submit a claim for items that have been exported via ocean freighter you don't need to send your original documents to our office in the post. You can submit all your documents digitally.

Your shipping company submits and receives digital export documents from harbour customs. These export documents are sufficient to prove that your goods have been exported to a country outside the EU.

Please keep any original receipts safe at home until after the store has processed your claim.

Yes, you can submit a claim for goods that have been exported by a shipping company oversees.

You can read about what documents you will need to provide here.

A detailed guide on how to register your claim in your account can be found here.

No. If you are a NATO employee you don't have to send your original documents to our office in the post. You may submit your claims digitally.

Am I eligible for a VAT refund? /| N | You're a non-EU resident and you purchase items in the EU for personal use in your non-EU homecountry |

| E | You export the goods to your non-EU homecountry before the end of the third month, after the month of purchase |

| M | You spend a minimum amount per store, per day |

| S | You receive a stamp from customs on a valid receipt (or other digital export confirmation) Digital export documents are always accepted if you export via courier (DHL, FedEX, UPS) or ocean freighter |

Other eligible groups include:

For more information about tax-free shopping in the EU: https://taxation-customs.ec.europa.eu/guide-vat-refund-visitors-eu_en

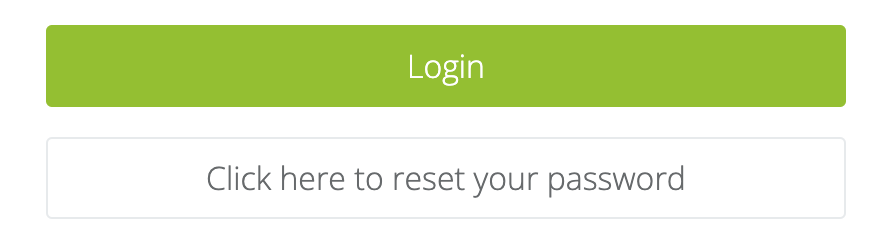

1. Go to the login page via our website or app and select the white button 'Click here to reset your password' (below the login button)

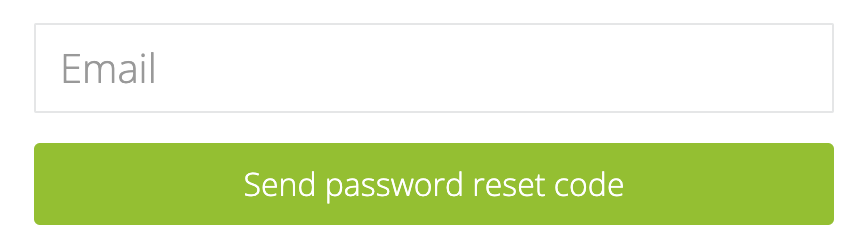

2. On the next page, fill in your email address and click the button 'Send password reset code'. Your reset code is sent to you by email.

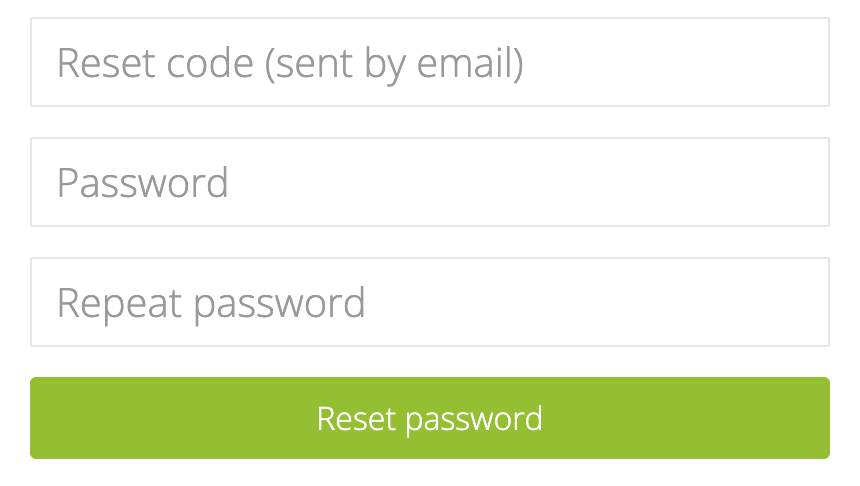

3. You can now enter the Password Reset Code we sent via email and choose a new password. You will be logged in automatically

After logging back into your account, if you can't see any previously registered receipts, it could be the case you have 2 accounts with Vatfree.com. Try to do another password reset for your other email address.

If you would like to merge your duplicate accounts, please contact us via [email protected].

Which documents do I need to bring to customs? - Airplane, car, train /

That depends on the EU country you are departing from. We advise you to check our country guides to see the rules for Customs in different EU countries.

Overall, most EU Customs departments want to see your:

This article applies to NATO military employees stationed in the Netherlands, buying at Dutch stores. If you're stationed inside the Netherlands and buying from stores located outside the Netherlands (but inside the EU), please follow instructions here. To request a VAT refund, please follow the steps below:

At the moment of purchase, ask for a Customs Tax Invoice

Store employees are required to fill in your CTI. A minimum purchase amount of €45 (per CTI) applies.

After visiting the store and receiving a CTI, go to your NATO base administration for a wet stamp / seal of approval.

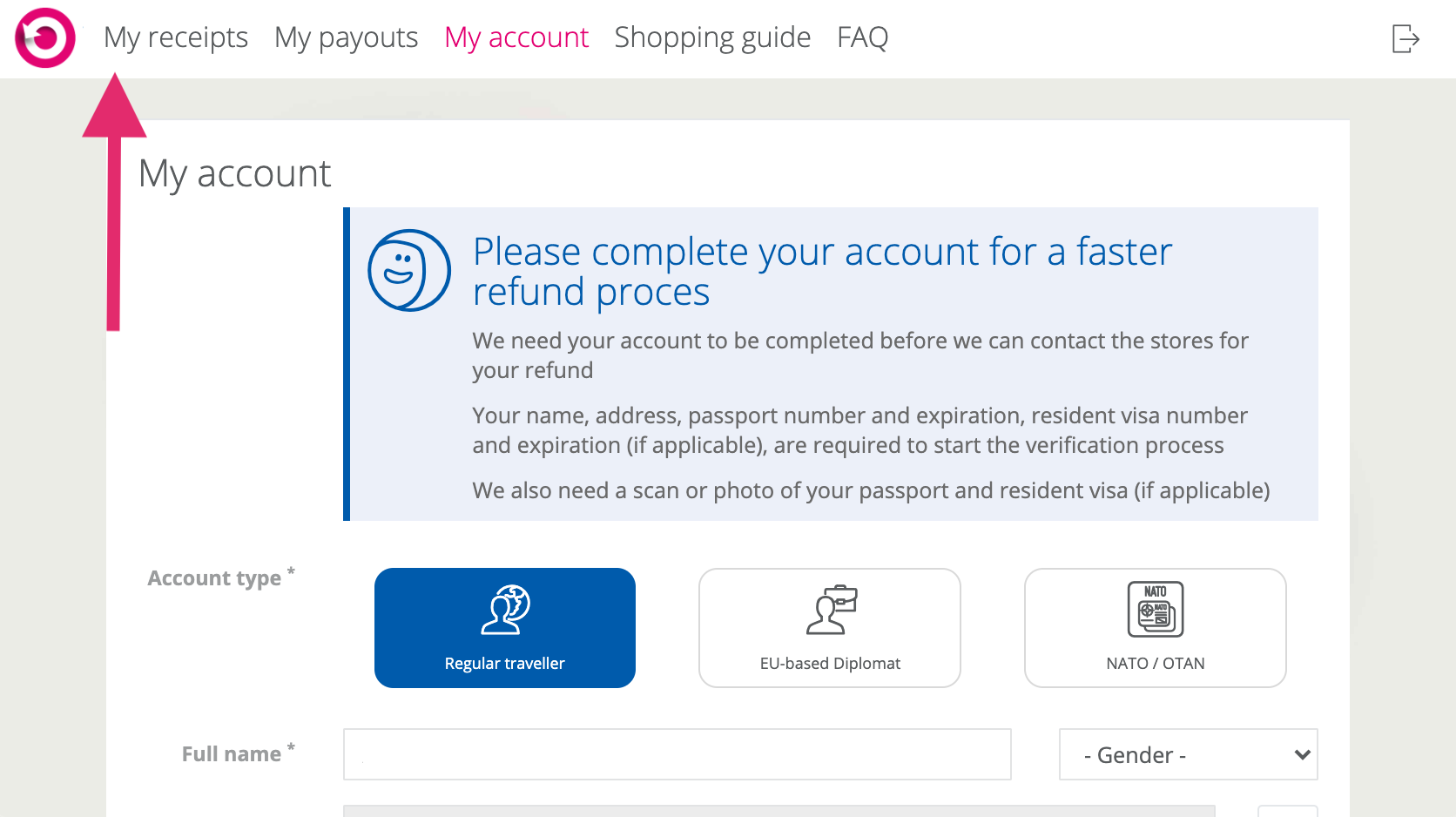

On your account page, set your 'account type' to the correct NATO base; Brunssum

On your receipt page, register your receipt and Customs Tax Invoice

When this process has been completed, we’ll check your documents and contact the store for your refund. You’ll be notified by email when a store has processed your claim. After receiving notification, payment can be requested by logging in to your account.

Additional remarks:

Claims may be submitted digitally

Original documents must be kept safe at home until after the store has processed your claim

VAT forms can be requested from stores via email

Did you make a purchase online? Or were you not able to get a CTI in-store for other reasons? You may request a CTI from the store via email. After forms have been filled in and sent to you by email, they must be printed and brought to your NATO base administration for a wet stamp / seal of approval.

You can only buy at licensed stores

Only stores with a licence to sell to JFC NATO military staff are able to provide this type of invoice. Your NATO base administration can provide a list of licensed stores.

Each country has an import free threshold. This threshold varies per country. If your purchase amount exceeds this threshold, you will be required to declare your goods and pay import duties upon arrival in your country of destination.

The thresholds of most countries can be found here.

For more specific information on import duties for the country you are exporting too, please visit their government website for more information.

Declaring goods is a responsibility every traveler has, whether the VAT is reclaimed or not. Once you leave the EU, it is up to customs in your non-EU home country to check that travellers declare their goods.

After completing this process we'll keep you updated by email automatically. We'll provide a time-frame for your refund and we'll notify you when your VAT has come in from the store. Information about payment methods can be found here.

Please read our full privacy statement here.

Where is the vatfree.com mailbox at the airport? /

Vatfree.com does not have special tax-free mailboxes at the airport. If we have asked you to mail your documents and you want to do so from the airport, please use a mailbox of the national regular postal service. Regular mailboxes and shops from national postal services can be found at different locations at the airport. If you are having difficulty finding a mailbox please ask an airport employee to point you in the right direction.

At Schiphol, Amsterdam airport you can use the orange mailboxes. There is an orange mailbox located across the hall from customs.

Don't forget to include your contact details and registration numbers. Use a proper envelope and a postal stamp.

Instead of wasting paper and trees, and to cut costs for lower service fees, we prefer to work completely digitally. We therefore don't have desks and mailboxes at the airport. In return, our partner stores generally no longer require you to submit original documents via post which means less hassle for you! They therefor no longer provide envelopes in-store.

Before sending mail:

Address for regular mail / national postal services | Address for courier mail (DHL, FedEx, UPS, etc.) |

| vatfree.com att: Web P.O. Box 37234 1030 AE Amsterdam The Netherlands | vatfree.com / TAV Hester Telephone number: +3188 828 37 33 |

Transaction costs can be 0 to 2 EUR, depending on the payment method you choose:

⚠️ Visa and Mastercard: 2 EUR + our payment in EUR might be converted to the main currency of your card or USD, subject to your Banks' and Visa/Mastercard policies on international transactions

⚠️ PayPal: 2 EUR

✅ European SEPA/IBAN: no transaction costs

✅ Alipay: no transaction costs

✅ WeChat: no transaction costs

To avoid paying transaction costs you can:

💡 Use European SEPA/IBAN, Alipay and WeChat as your payment method

💡 Wait until all stores have paid your refunds so you only pay the transaction fee once

Information about our Service Fee can be found here.

If customs is closed:

Please note that without a stamp from customs, we can't process your claim. No stamp = No refund. The tax-administration does not allow us to process claims without proof of export from customs, no matter what the reason was if you were not able to get a stamp. Processing a claim without a stamp can result in high fines for our company and the store. We kindly ask for your understanding in this matter.

Most stores guarantee a VAT refund and process your claim in a timely manner.

For some stores it can take a bit more time and we might need to take legal action to retrieve your VAT.

The coloured logos in our shopping guide tell you if a store refunds VAT on first request and in a timely manner.

More than 55.000 stores have already refunded VAT via Vatfree.com, so there’s more than enough choice for you to shop Tax-Free, hassle free, in the neighbourhood and online.

Information about our service fee can be found here.

Single Euro Payments Area | Transaction Costs: 0 EUR Notes: Single Euro Payments Area, European IBAN accounts. Please check whether your country and bank account are supported for the SEPA payment method. A list of countries can be found here. |

| Alipay | Transaction Costs: 0 EUR Notes: How can I find my Alipay ID? |

| WeChat | Transaction Costs: 0 EUR Notes: - |

| MasterCard | Transaction Costs: 2 EUR Notes: Depending on your Banks' and Visa/Mastercard policies on international transactions, if you have a non-EUR or multi-currency card, our payment in EUR might be converted to the default currency of your card + conversion costs might be charged. |

| Visa | Transaction Costs: 2 EUR Notes: Depending on your Banks' and Visa/Mastercard policies on international transactions, if you have a non-EUR or multi-currency card, our payment in EUR might be converted to the default currency of your card + conversion costs might be charged. |

| PayPal | Transaction Costs: 2 EUR Notes: Your PayPal account must be set to accept payment in EUR. In your PayPal account, go to Settings --> Money, banks and cards --> Add a Currency. Once you've received our payment in EUR, this will be converted to your local currency when you transfer the amount to your local bankaccount. |

Frequently Asked Questions

Do I have to use my own bank account?

How can I avoid paying transaction costs?

Which bank accounts can be submitted for the IBAN/SEPA payment method?

Can I get a cash refund at the airport?

Do Russian sanctions effect my payment?

What do the coloured logo's in the shopping guide mean? /

The coloured logos in our shopping guide tell you if a store refunds VAT on first request and in a timely manner. Most stores guarantee a VAT refund and process your claim in a timely manner. For some stores it can take a bit more time and we might need to take legal action to retrieve your VAT. More than 55.000 stores have already refunded VAT via Vatfree.com, so there’s more than enough choice for you to shop tax-free, hassle free, in the neighbourhood and online.

If you leave the EU by car, you can get a customs stamp at a European Customs office on the EU border (the last EU country before crossing the border).

You can also get an import stamp at the non-EU Customs office over the border. Be aware that non-EU Customs might ask you to pay import duties.

✅ Take a look at our map to find Customs offices along the EU border

✅ Check our country guides to see the rules for Customs in different EU countries.

Overall, most EU Customs departments want to see your:

Purchase documents (showing your name, non-EU address and passport number)

In some EU countries you must provide a Tax-Free form for every purchase

Purchased items (labeled and packaged)

Passport

If you have a EU-passport, you must show a visa or residence permit from a non-EU country

Boarding pass

If the store where you shopped is not listed or has a white logo in our guide, this means that they have never refunded VAT via vatfree.com before. Feel free to register the new store and your receipt. We'll then continue to contact them and negotiate a refund on your behalf. If they don't want to cooperate we won't charge a fee.

We advise you to contact new stores directly first. Cc us in your message to the store so we can assist. A short message is sufficient, just to let them know you wish to submit a claim via vatfree.com. New stores are often more willing to cooperate if you let them know personally beforehand that you want to submit a claim.

Shopping Tax-Free = claiming a Value Added Tax (VAT) refund.

VAT is a consumer tax and varies between 4% and 27% in the EU. It is included in all prices you pay for goods and services.

You're eligible for a VAT refund if you live outside the EU and if you export the goods to your non-EU country of origin. You first pay VAT in the store when you buy goods, and claim it back after leaving the EU.

Requirements

A VAT refund is only possible over goods, not services.

Items must be exported to a country outside the EU before the end of the 3rd month, after the month of purchase.

The goods must be for private use in your non-EU home-country of origin.

You must get proof of export from customs to show that your items left the EU. You can pass by customs at the airport, at a train station or highway border office. Customs will stamp your documents from the store or provide digital export validation.

You can also export via ocean freight or courier services such as DHL, FedEx, UPS, and other carriers.

Frequently Asked Questions

Can I get a VAT refund from any store?

Where can I get proof of export?Where can I upload proof of export?

How can I verify my account?

What is your service fee?

💡NATO employees, diplomats working in the EU, and people working for international organizations may also be exempt from paying VAT.

If you are/were not able to get a stamp:

Please note that without a stamp from customs, we can't process your claim. No stamp = No refund. The tax administration does not allow us to process claims without proof of export from customs, no matter what the reason was if you were not able to get a stamp. If you feel you were not in fault for not being able to get a customs stamp, please contact customs directly to file a complaint and request a rectification.

How do I know you have received my receipts? /When we have received and processed your original stamped receipts at our office, we will notify you in the message center of the app and by email.

You can also keep an eye on the status of your receipts by logging in to your account and going to the 'my receipts' page. When we have received and processed your original receipts, your receipt status will change from 'waiting for originals' to 'waiting for visual validation'. This means we are in the process of checking and approving your receipt.

Before sending mail:

Address for regular mail / national postal services | Address for courier mail (DHL, FedEx, UPS, etc.) |

| vatfree.com att: Web P.O. Box 37234 1030 AE Amsterdam The Netherlands | vatfree.com / TAV Hester Telephone number: +3188 828 37 33 |

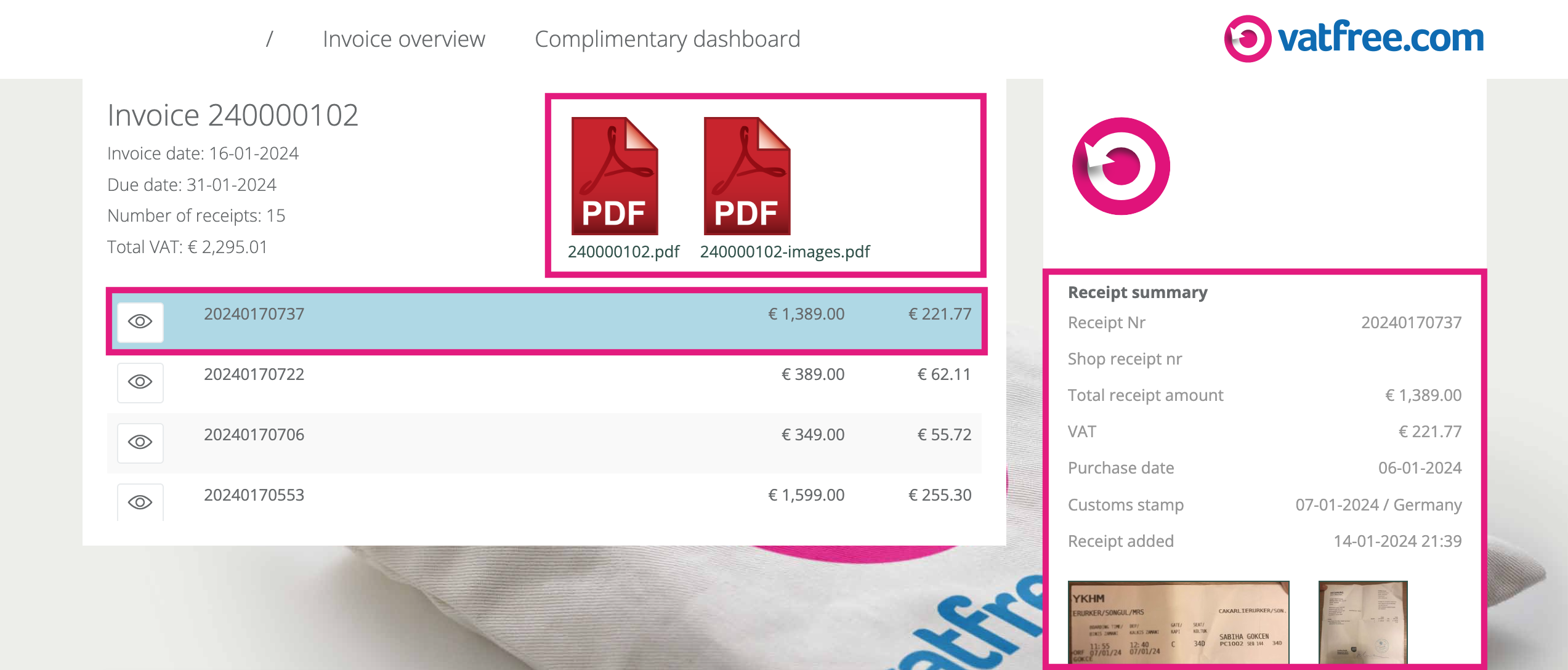

In every invoice email we send you, you can find a link to your personal store portal. In your personal shop portal you can find an overview of all your open and paid invoices.

On every invoice page you will find two PDF files:

1. Your invoice

2. Image scans of your customers original receipts and their tax-free forms

We advise you to bookmark your shop portal so you can access your documents at all times.

Tax-free forms can be downloaded here:

Information leaflets and window stickers can be ordered free of cost via email:

Please provide your store name and address. As soon as we have received your request your order will be packed and mailed or dropped off at your store.

Many shops will print a different warranty receipt that it is not part of the purchase receipt. If you don't receive a second warranty receipt from the store, please make a copy/photo of the receipt or have a copy of the receipt stamped at EU-Customs so you can keep the original (customs will only stamp a copy if you can show them the original at the same time).

What is your service fee? /We guarantee the highest refund in the Tax-Free market and we're proud of it! If you find a lower service fee somewhere else, let us know and we'll adjust the refund amount for you.

✅ Use our Refund Calculator to see exactly how much you get back with Vatfree.com.

We charge a service fee of 28% of the VAT on your purchase receipt, with a minimum of €2,50 and a maximum of €80,- per receipt.

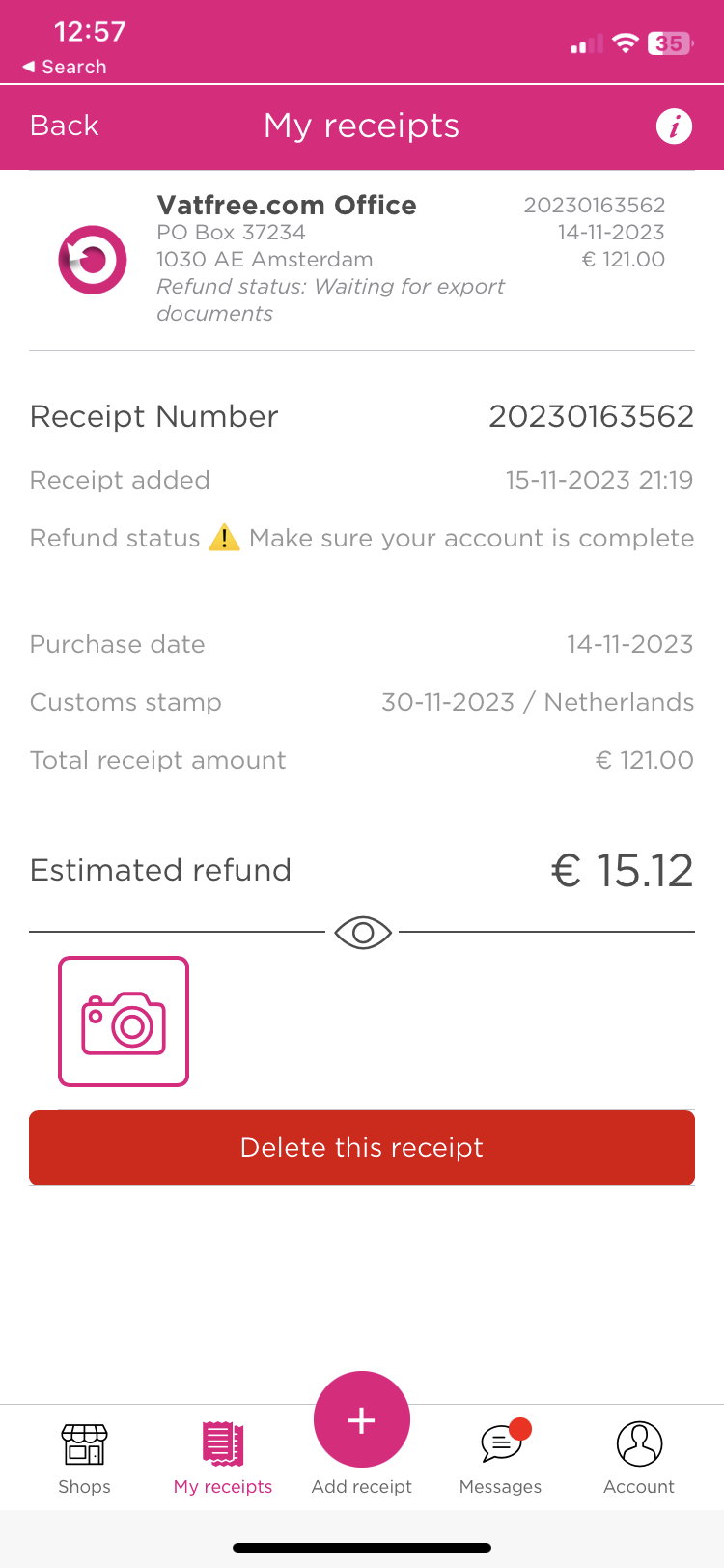

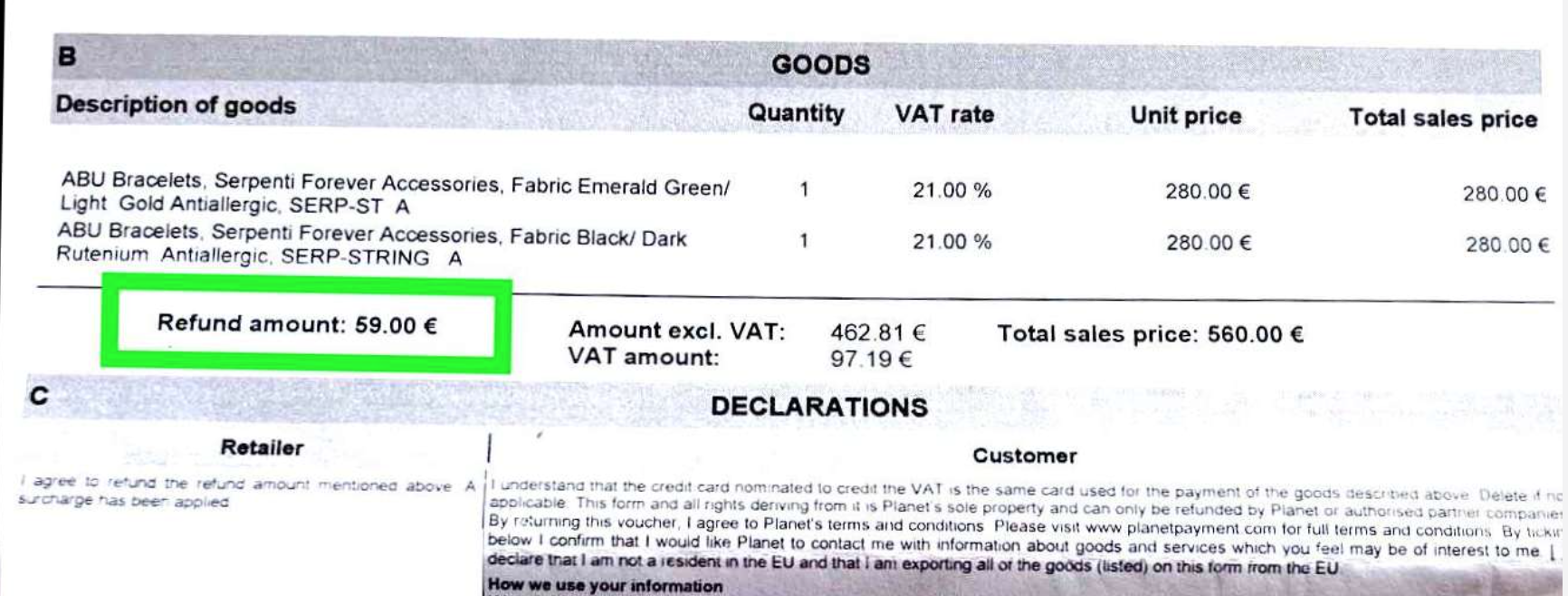

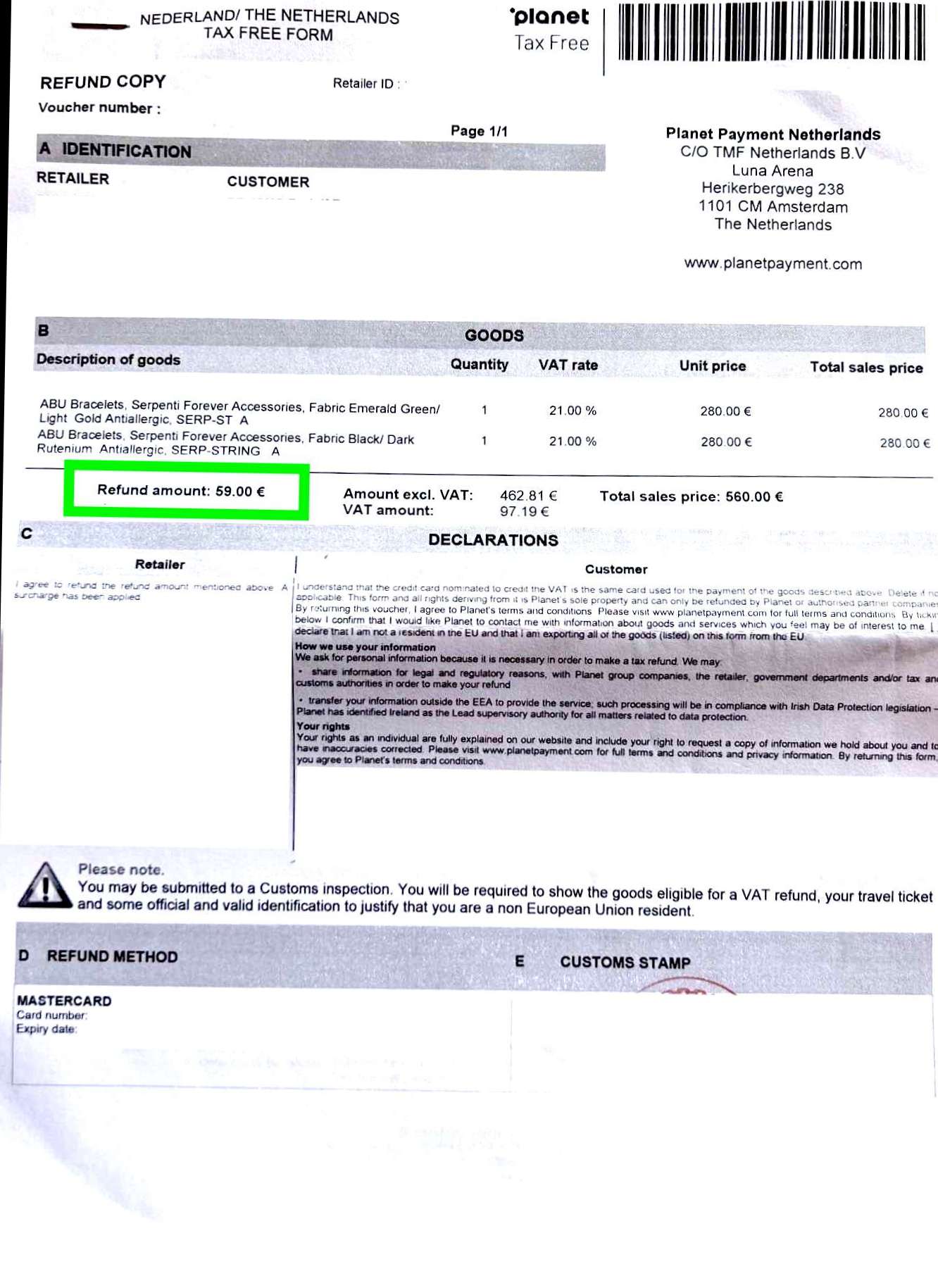

| Example1 | Example 2 | |

| Total purchase amount (incl. VAT) | €121,- | €2500,- |

| VAT amount | €21,- | €433,88 |

| Service fee (28% of the VAT, max. €80,-) | €5,88- | €80,- |

| Refund | €15,12 | €353,88 |

⚠️ Additional transaction costs might be charged depending on which payment option you choose.

We work on a no-cure no-pay basis; we only charge a fee when the store refunds your VAT.

Frequently Asked Questions

What if I find a lower service fee somewhere else?

How do Vatfree.com fees compare to other Tax-Free companies?

Vatfree.com Refund Calculator

Are there any additional transaction costs?

Yes, please always use a postal stamp on your envelope.

You can find our address here.

International students and expats living in the EU /If you're an international student or expat staying in the EU for six months or less, you are eligible for a VAT refund.

If you are staying in the EU longer than six months you can get a refund when you permanently leave the EU. To get a VAT refund you need to de-register from city hall. You will receive a confirmation of your de-registration for customs, to get proof of export.

Please note;

We can not return your original receipt or forward it to another company.

Please only send your receipts in the post if the app tells you to do so. Not sure? Contact us: [email protected].

Before you send your receipts in the post, please check our shopping guide first to determine wether a store will cooperate with refunding your VAT via vatfree.com.

Our terms and conditions (article 8) and our shopping guide mention that we are unable to return or forward original receipts to customers, uncooperative stores or competitors. This would become very costly and time consuming, especially since we do not charge a service fee for receipts and the corresponding VAT amount in when they are not refunded by the store.

If you need your receipt for warranty reasons, ask the store to print a copy of the receipt which you can use for that purpose. Often they will provide this automatically during purchase. Always ask to be sure.

We do not pay you automatically. The payment option will become available after a store has processed your claim. When we receive your VAT from the store, we'll inform you immediately via email and the app.

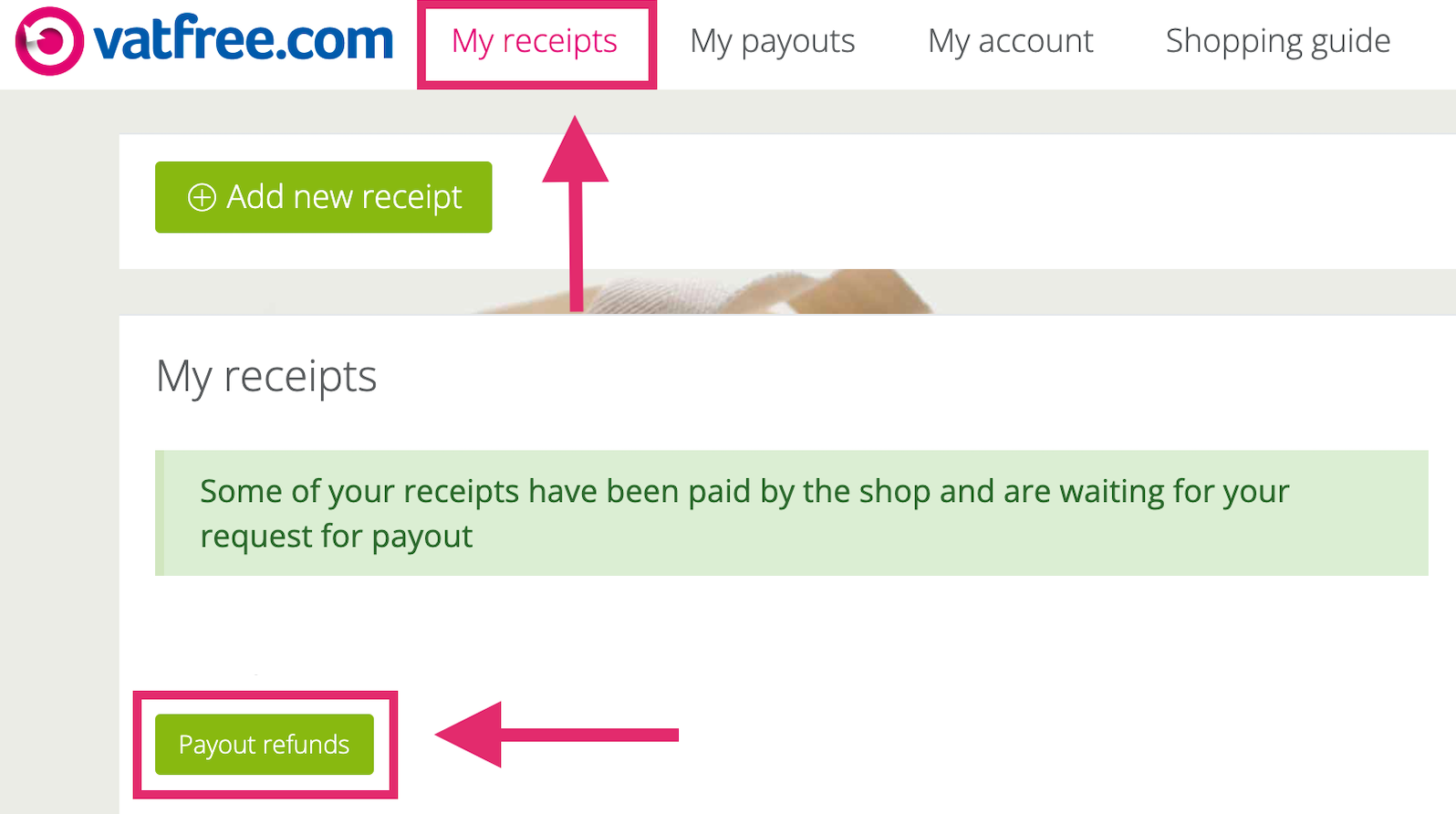

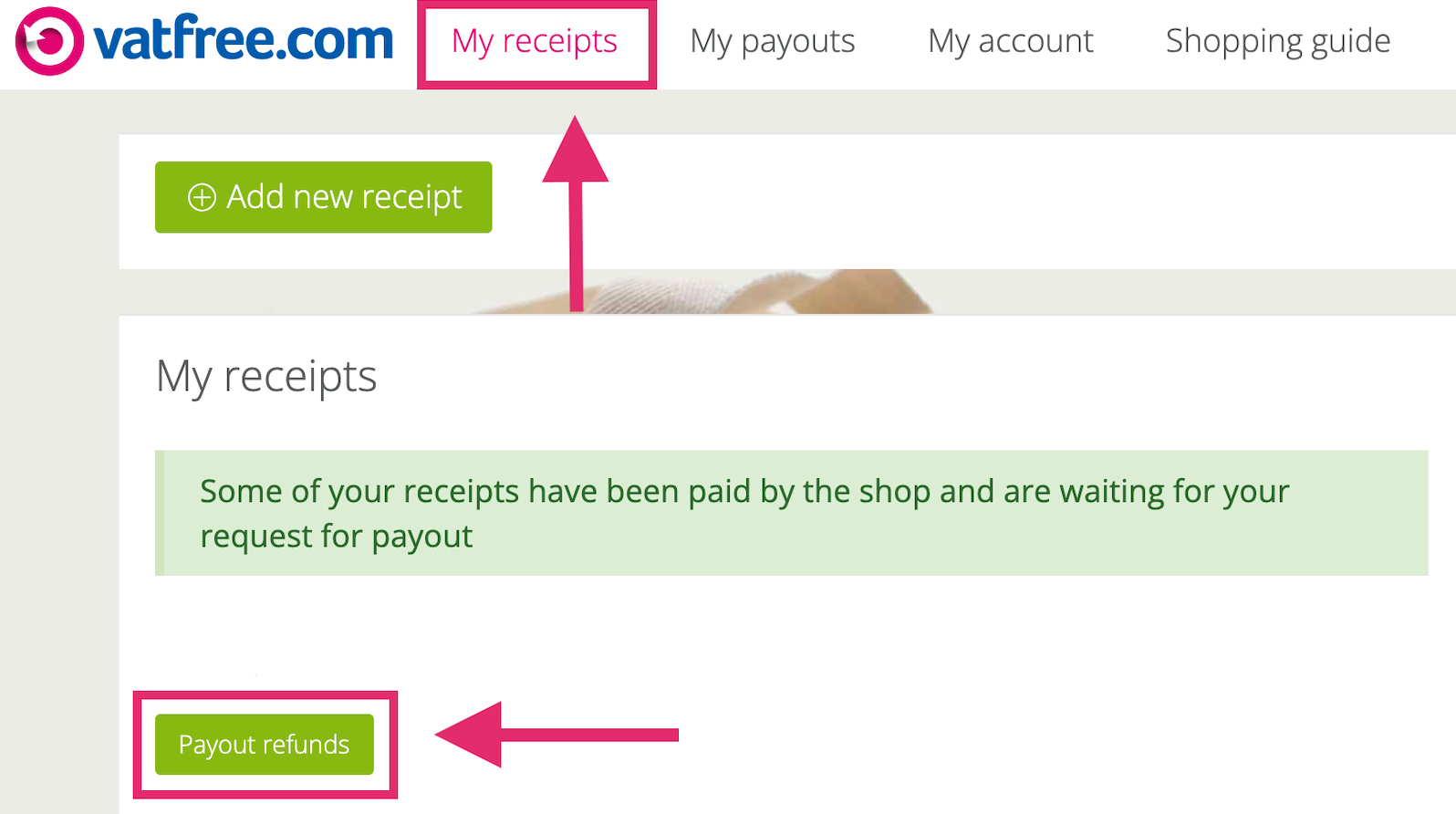

You can request payment via the 'My receipts' page in your account. Select the green 'Payout refunds' button to start the payment process.

Information about your payment date can be found here.

We guarantee the highest refund in the Tax-Free market and we're proud of it! If you find a lower service fee somewhere else, let us know and we'll adjust the refund amount for you.

✅ Use our Refund Calculator to see exactly how much you get back with Vatfree.com.

We charge a service fee of 28% of the VAT on your purchase receipt, with a minimum of €2,50 and a maximum of €80,- per receipt.

| Example1 | Example 2 | |

| Total purchase amount (incl. VAT) | €121,- | €2500,- |

| VAT amount | €21,- | €433,88 |

| Service fee (28% of the VAT, max. €80,-) | €5,88- | €80,- |

| Refund | €15,12 | €353,88 |

⚠️ Additional transaction costs might be charged depending on which payment option you choose.

We work on a no-cure no-pay basis; we only charge a fee when the store refunds your VAT.

Frequently Asked Questions

What if I find a lower service fee somewhere else?

How do Vatfree.com fees compare to other Tax-Free companies?

Vatfree.com Refund Calculator

Are there any additional transaction costs?

If you're traveling by airplane, there are multiple options to get proof of export:

1. Pass by Customs at your EU airport of departure

Customs desks are available at all international airports in the EU, 24/7.

Customs is usually located in departure halls, close to check-in desks. Follow the signs for customs or ask an airport employee to point you in the right direction.

If the customs desk is closed there is usually a telephone number displayed on the desk which you can call outside of opening hours. A customs employee will come down to the desk to stamp your receipts.

✅ View our airports and customs guide to see exactly which documents you need for customs in the EU country you're departing from

✅ Plan in some extra time at the airport for customs - 30 minutes is usually enough

✅ Bring a Tax-Free form if you did not receive a valid purchase document from the store.

2. Declare your goods at your non-EU airport of arrival

As a backup plan, you can also 'declare your goods' at our non-EU airport of arrival. These offices are usually located between the baggage claim belts and the exit. You might be asked to pay import taxes and duties.

3. Visit an embassy or consulate in your non-EU country of arrival

As a last resort, you might be able to visit the embassy of the EU country you departed from or the embassy of the country where you bought your goods. Call the embassy first to ask if they can help. Some embassies will direct you to a customs department. Bring the following with you:

➤ Tax-Free form

➤ Purchase receipt

➤ Purchased items

➤ Flight itinerary showing when you exited the EU

➤ Passport

➤ If you have an EU passport; another non-EU official government document proving you life outside the EU (visa, work-permit, residence-permit, etc)

⚠️ No proof of export = No refund

We can't process your claim without proof of export from customs (stamp or digital export validation). EU Tax Administrations do not allow us to process claims without export validation. Doing so can result in high fines for our company and stores. We kindly ask for your understanding in this matter.

Frequently Asked Questions

Which documents do I need to bring to customs?

Do my items need to stay in their original packaging?

What if customs is closed?

Yes, you can, and we encourage you to do so, for compliance purposes and to improve your customer journey. EU law states a 0% VAT rate applies to exported goods. Customers working for NATO and certain other EU institutions are also exempt. VAT should be refunded directly to the customer or his/her representative. You may promote a tax-free company in-store, but you may not impose the use of this company as a condition for refunding VAT. Respecting customers’ freedom of choice and removing disproportionate barriers to obtain a VAT refund contributes to a positive customer journey, strengthens your Brands’ competitive position in the market and ensures you stay compliant with EU law.

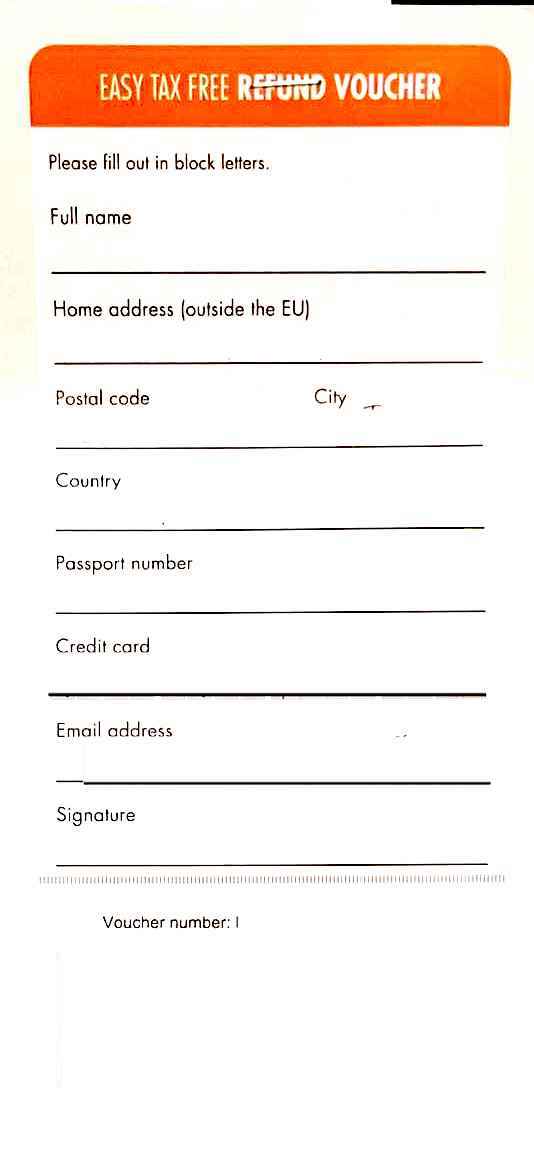

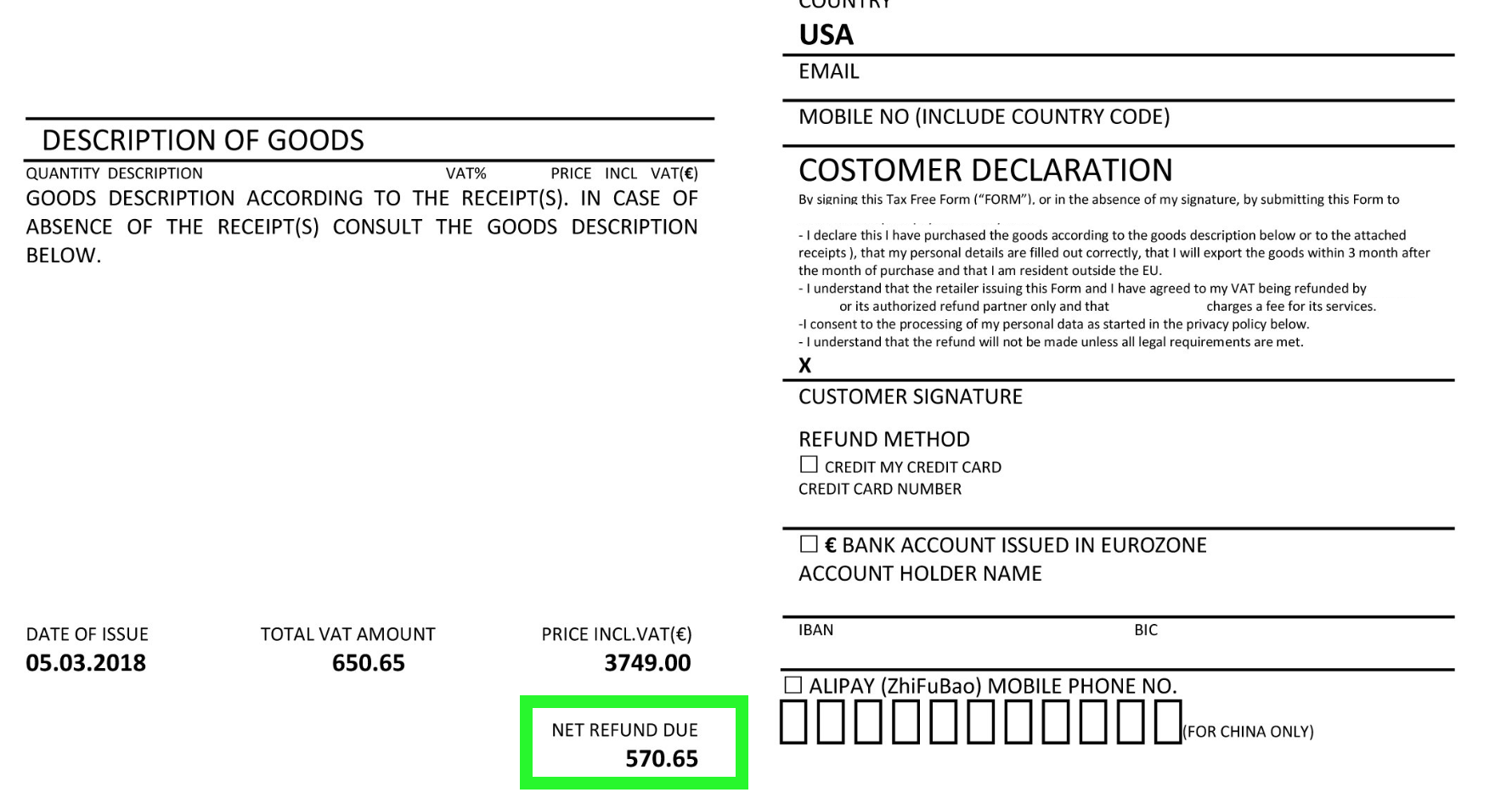

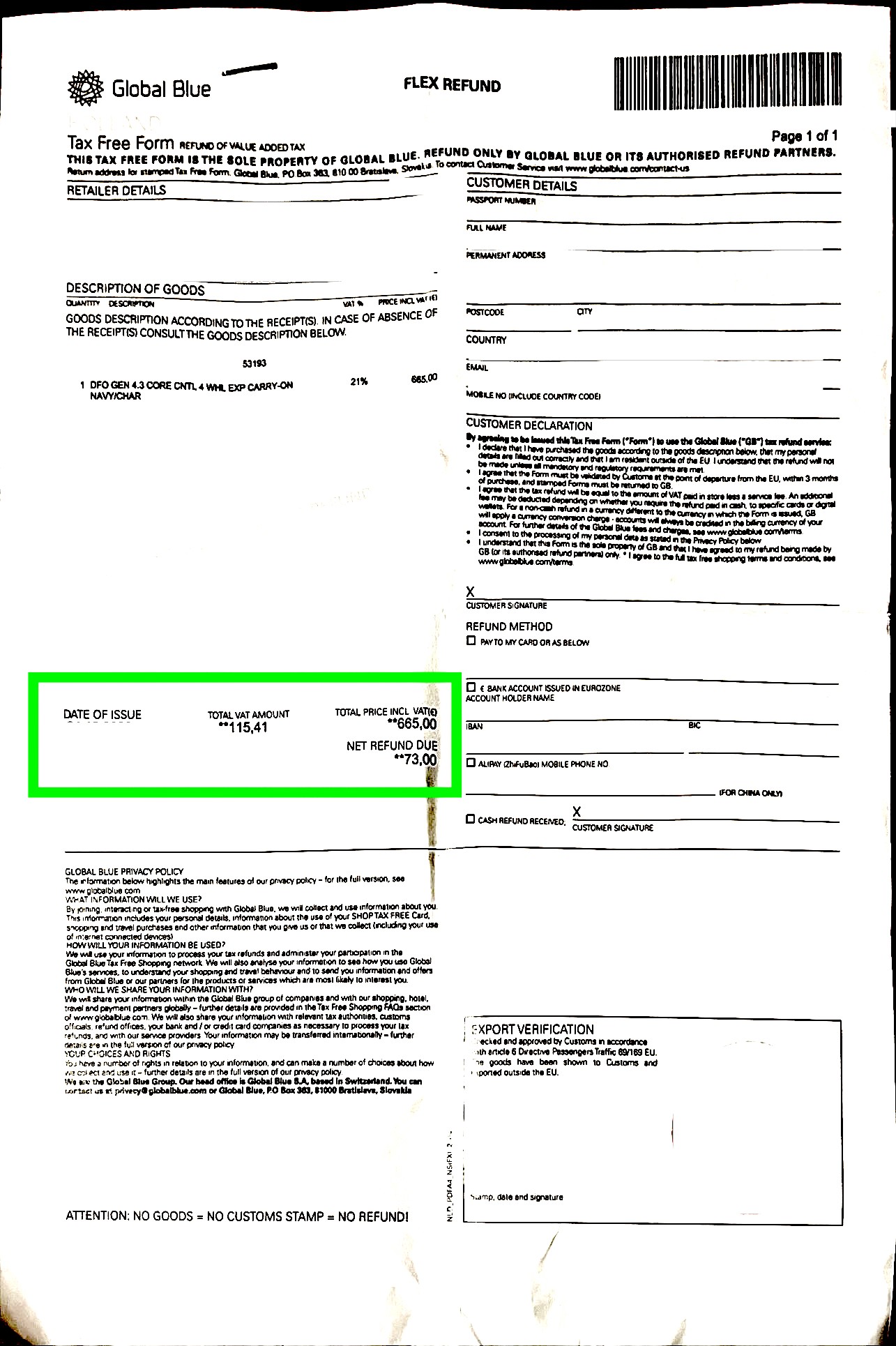

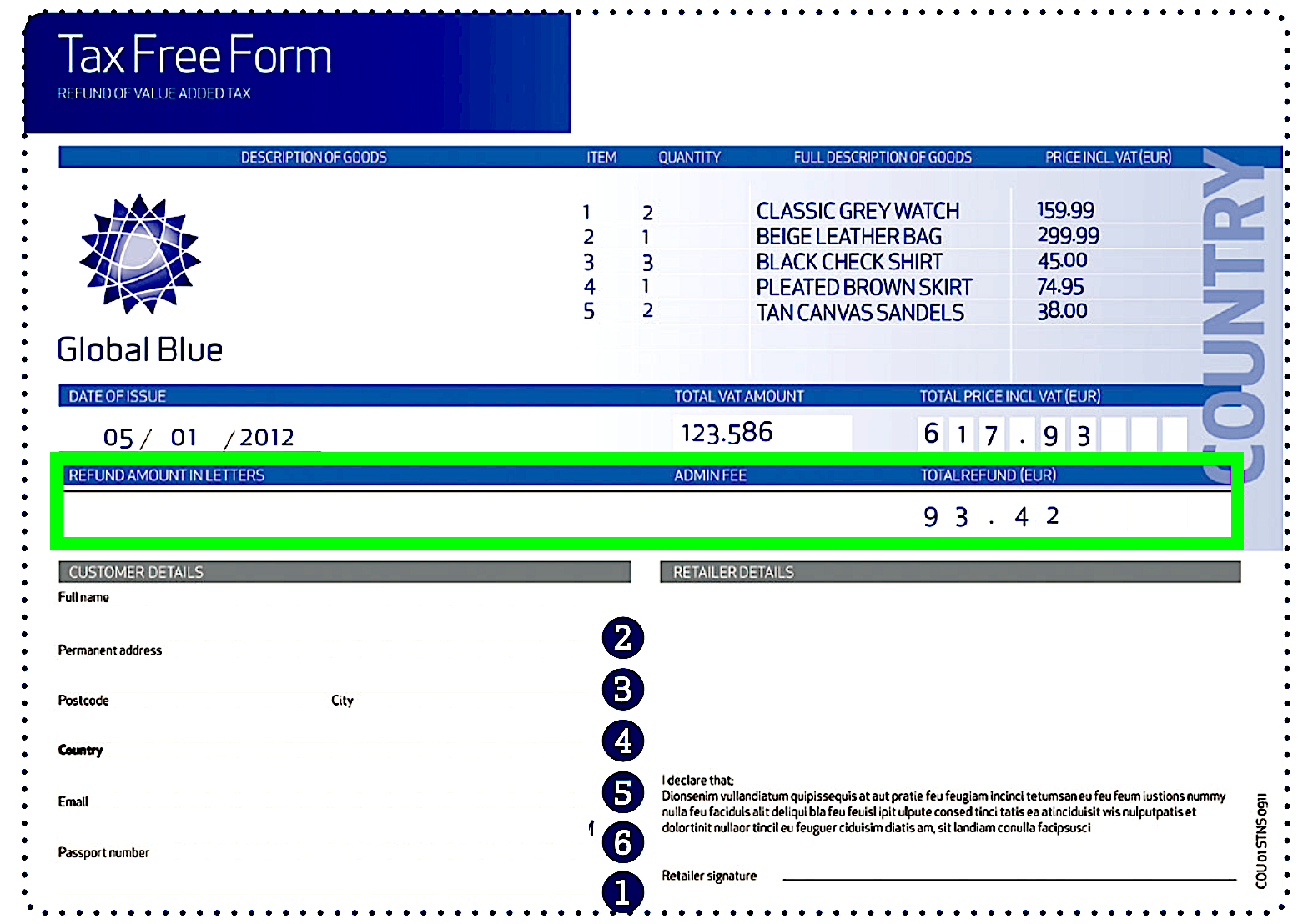

What are the requirements for purchase receipts? /In most EU countries, your purchase documents must show the below information, to get proof of export from customs and a VAT refund from the store.

The below information must be visible on your purchase document(s) from the store. This can be a receipt, invoice or Tax-Free form.

Your details

Name, passport number, country of residence

Store details

Store name and address

Purchase date

Description of goods

Total purchase amount

Total VAT amount

✅ Most stores can add your details to a receipt or invoice if you ask

✅ Some stores will give you a special Tax-Free receipt or Tax-Free form with these details included

✅ If the store can't add your details to the purchase document, you can download a Tax-Free form for customs here

✅ Take a look at our country guide to see exactly which documents you must bring to customs in the EU country you are departing from

In general, we can not process receipts if the minimum spend threshold has not been met.

There is one exception:

If you have multiple receipts, from the same store and same day, you are allowed to combine your receipt with a low purchase amount with your other receipt from the same store and same day. The total purchase amount of the receipts combined must be higher than the minimum spend amount.

European Union tax law states that a 0% VAT rate applies to exported goods. NATO employees and persons working for exempt EU institutions benefit from 0% VAT rates as well. If you meet all the requirements and export has been confirmed by customs, the store should refund the VAT which was paid when you purchased the goods.

Unfortunately, some stores don't cooperate. Either because they don't understand the regulation, the administrative procedures involved or because they have an exclusive contract with a different tax-free company. These reasons are legally invalid for rejection of your claim.

If a store doesn't want to cooperate, there are 2 things you can do:

Having proof of export/VAT exemption provided by a customs or tax department is a legal requirement for submitting and processing VAT refund claims. This requirement has been set by EU government(s) and is enforced by tax administrations in all EU countries.

Please note that without proof of export provided by a customs or tax department, we can't process your claim. No proof of export = No refund. Tax administrations do not allow us and stores to process claims without proof of export, no matter what the circumstances were. Processing a claim without proof of export from customs can result in high fines for our company and the store. We kindly ask for your understanding in this matter.

What documents do I need for items exported via ocean freighter? /Your name and an invoice/order/transaction number from the store is mandatory information and must be included on your documents. Without this information we can't process your claim.

Tip: Contact your shipper and ask them to include this information on your customs documents. They don't always do so automatically. To help them avoid making mistakes, send a list of store names and invoice/order/transaction numbers.

If the above mentioned details are not visible on your customs documents, you can submit the following documents from your shipper as support:

Where can I get a customs stamp? - Train /

Information about Amsterdam Central Station can be found here.

The locations of customs desks and officers can vary per train station and are frequently subject to change.

Customs can be present;

Please contact the station and customer support of your train operator well in advance before your departure date to find out where you have to go to get a stamp. We also accept stamps from your non-EU station of arrival and European embassies.

Please note; without a stamp from customs we can't process your claim.

I receive an error while trying to upload documents in the app. What now? /If you're having trouble uploading images/documents to the app you can try the following:

If you wish to submit your receipts for a VAT refund from Schiphol airport, please deposit your envelope with original stamped receipts in the orange mailbox located across the hall from customs. This is a mailbox belonging to the Dutch national postal (Postnl) service. If (in departure hall 3) you deposit your envelope with receipts in this mailbox, your receipts will arrive at our office in safe and good order.

Read more on our page about Schiphol How do I register a new store in your shopping guide? /If the store where you shopped is not listed or has a white logo in our guide, this means that they have never refunded VAT via vatfree.com before. Feel free to register the new store (instructions below) and your receipt. We'll contact them and negotiate a refund on your behalf. If they don't want to cooperate we won't charge a fee.

We advise you to contact new stores directly first. Cc us in your message to the store so we can assist. A short message is sufficient, just to let them know you wish to submit a claim via vatfree.com. New stores are often more willing to cooperate if you let them know personally beforehand that you want to submit a claim.

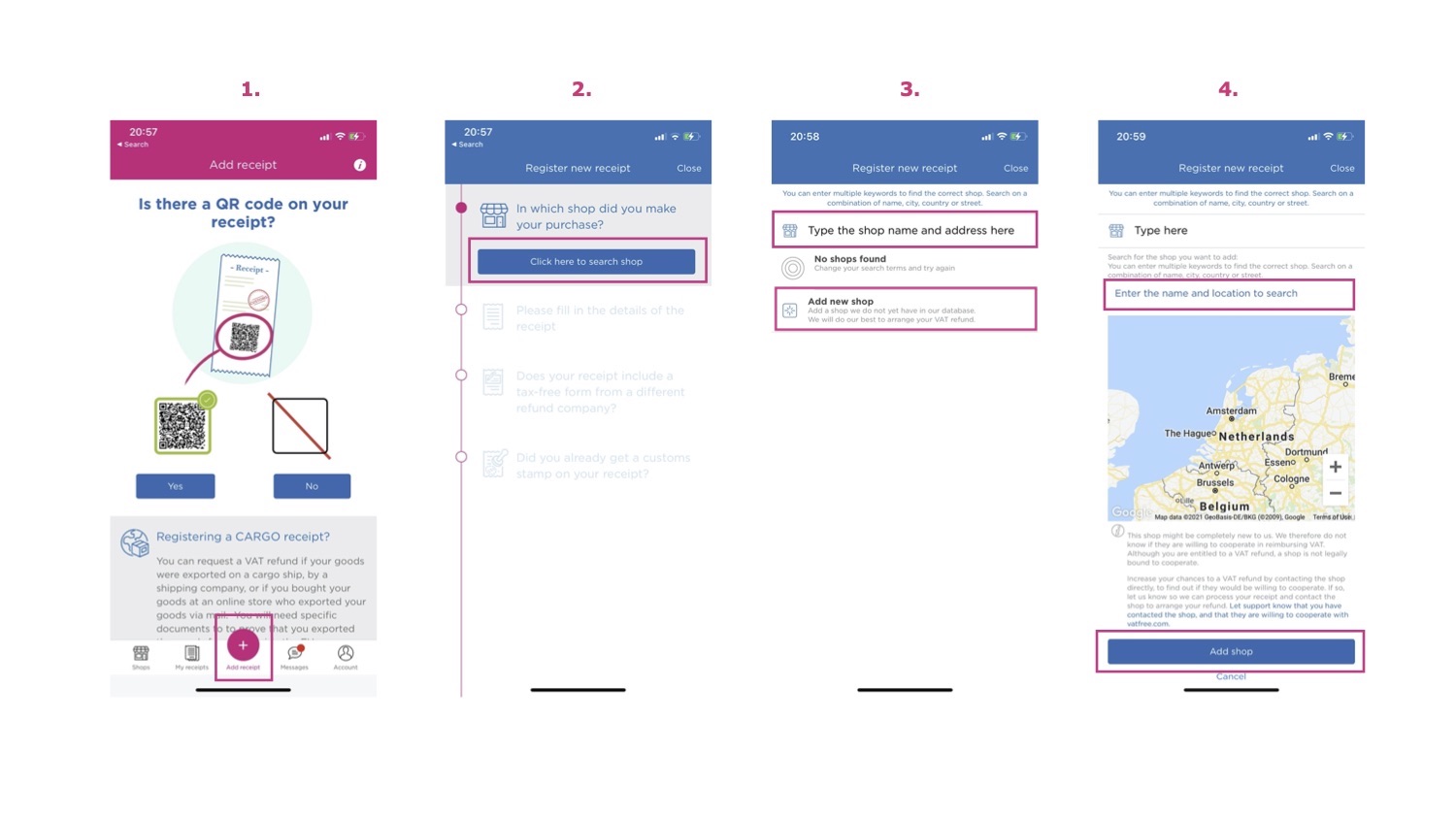

You need to be logged in to your account to add a new store to our system. When logged in, follow the steps below:

Congratulations! You've added the store to our shopping guide!

How long before my receipts arrive at your office? /Mail is delivered to our office once a week. Afterward, it can take up to two weeks to register all receipts we have received. Therefore, it can sometimes take up to three (3) weeks in total before your receipts are marked as 'received' in your account.

When we have received and processed your original receipts, we'll notify you by email and the messages page in the app.

You can also keep an eye on the receipt status, on your receipt page. When we have received and processed your originals, your receipt status will change from 'waiting for originals' to 'waiting for visual validation'. This means we're in the process of checking and approving your documents.

If you still haven't heard from us 3 weeks after your receipts should have arrived, please let us know via [email protected].

No, you do not need to use your own bank account to receive your refund. You can also use the bank account of a family member or friend, or you can donate your refund to an NGO.

Can you donate my refund to an NGO? /Yes, we are more than happy to transfer your refund as a donation to an NGO like the Red Cross, Wildlife Protection (WNF) or a project of your choice.

If you are interested in donating, you can simply fill in the details below during the request of your payment. To donate to a project of your choice, find their bank details online and submit them during the request of your payment.

Red Cross:

Wildlife Protection WNF (Wereld Natuur Fonds):

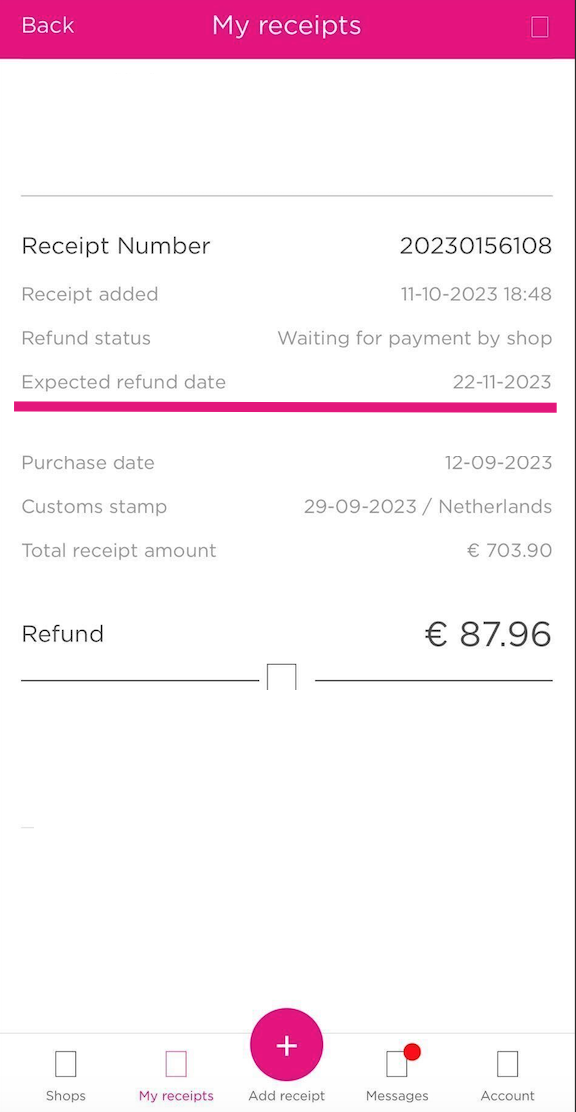

You can find the expected refund date in your receipt details:

Go to 'My receipts' ➤ Select a receipt ➤ View the receipt details

The expected refund date will become visible after your account has been verified and your receipt has been approved (you need to upload proof of export first).

🕐 Timeframes can be different per store

Each store has different payment processes and terms.

Some stores pay within a day, others within 1 week, 14 days, 30 days, 60 days and a few even ask for 90 days.

The average processing time is 30 days.

⚠️ The expected refund date is a prediction

It's based on the average amount of days it took the store to process claims of other customers in the past.

Payments can come in earlier and later than expected.

✅ We'll notify you automatically

When the store has transferred the VAT to our accounts, we'll inform you automatically via email and the app.

You can find out how to request payment here.

If a store has not paid within 2 weeks after the expected refund date, ask for an update via [email protected].

Frequently Asked Questions

Do you pay me automatically?How can I verify my account?

How can I track the status of my claim?

Don't worry! In most cases you don't need to send original documents by post.

There are some exceptions.

Check your receipt status on your receipt page. Is your receipt status 'waiting for original'? Then we need to receive your originals by post. If you're not sure whether your receipt needs to be posted, please contact us by email ([email protected]).

Always make photos/scans of your receipts before you send them in the post.

Our address for postal mail can be found here.

Vatfree.com does not have special tax-free mailboxes at the airport. If we have asked you to mail your documents and you want to do so from the airport, please use a mailbox of the national regular postal service. Mailboxes of regular postal services can be found at different locations at the airport. If you are having difficulty finding a mailbox please ask an airport employee to point you in the right direction.

At Schiphol, Amsterdam airport you can use the orange mailboxes. There is an orange mailbox located across the hall from customs.

Don't forget to include your contact details and registration numbers. Use a proper envelope and a postal stamp.

Instead of wasting paper and trees, and to cut costs for lower service fees, we prefer to work completely digitally. We therefore don't have desks and mailboxes at the airport. In return, our partner stores generally no longer require you to submit original documents via post which means less hassle for you! They therefor no longer provide envelopes in-store.

What if I don't want to share a copy of my passport? /The Dutch tax administration obligates us to store a copy of your passport. If we do not store a copy of your passport we (and the store) risk receiving large fines due to an incomplete administration. We kindly ask for your understanding in this matter.

If you don't want to share a copy of your passport we can make an exception for you if you file a complaint against the Dutch tax administration. You can file a complaint here. Don't forget to send us your complaint form by email ([email protected]) so we can verify your account.

Filing a complaint against the tax administration does not effect you as a traveller to the Netherlands or Europe. It is standard and accepted procedure.

Don't want to file a complaint against the tax administration? Check out our guide on how to safely share the copy of your passport. We give you tips on how to block your sensitive information. This makes identity theft with the copy of your passport extremely difficult and unlikely to occur.

Become Vatfree.com Partner ✅

What you'll be getting, for free:

➤ Vatfree.com in-store app for iOS, Android and web

➤ Professional administration for VAT refunds

➤ The highest VAT refund for customers, guaranteed

➤ Expert advice and service for Tax-Free customers

➤ Online overview of all Tax-Free claims and invoices

➤ Unlimited and free promotional material for your store

➤ Data about your Tax-Free and international sales

➤ Extra online visibility in our Shopping Guide and on our socials

Costs with Vatfree.com for POS

Some POS companies charge a fee for activating the Vatfree.com app for POS.

You don't have to connect via POS. You can also use our free in-store app, for iOS, Android and web.

Register for free online, here.

Need more info before signing up? Contact us:

Email: [email protected]

Phone: +31 88 828 37 33

On weekdays between 10:00 - 17:00 CET

✅ You can register online here.

Have any questions? Don't hesitate to contact us:

Email: [email protected]

Telephone:+31 88 828 37 33

💡 Want advice for a large enterprise?

Interested in signing up different entities and stores, in 1 or various EU countries? You might want to discover all our options first. Don't hesitate to book a call via [email protected] or contact your Vatfree account manager.

Can I work with Vatfree.com if I am already partnered with a different Tax-Free company?

What is your service fee for my customers? /For you as a retailer, our services are free. Your customer pays a fee. We guarantee the highest refund in the Tax-Free market, and we're proud of it!

✅ Use our Refund Calculator to see exactly how much your customers get back.

Our fee structure is simple:

For every store and receipt, we charge a standard fee of 28% of the VAT with a maximum of 80 EUR per receipt.

A maximum fee is unique in the Tax-Free market. With big purchases and VAT amounts, our max. fee can save your customers hundreds of € compared to refunds from competitors.

Frequently Asked Questions

Vatfree.com Refund Calculator

Are there any additional transaction costs?

Why do my customers pay a service fee?

How do Vatfree.com fees compare to other Tax-Free companies?

For questions about your invoice, please contact:

Email | [email protected]

Telephone | +31 (0) 88 828 37 33

How do I know my customer has exported his/her goods? /Vatfree.com receives and verifies all required documents for confirmation that your customer is eligible to shop Tax-Free and that export has been confirmed by Customs.

Customers are eligible for a VAT refund if:

If a customer is eligible, customs provide confirmation of export in the form of a stamp or digital export documents.

Customs checks:

Vatfree.com checks:

If all documentation is compliant and export of the goods has been confirmed by Customs and checked by Vatfree.com, we send you a request for VAT refund.

Which bank accounts can be submitted for the IBAN/SEPA payment method? /IBAN/SEPA bank accounts from the below mentioned countries can be submitted for our IBAN/SEPA payment method. If your country is not included in the below mentioned list, please select a different payment method.

Country |

| Currency |

|---|---|---|

Belgium |

| EUR |

Bulgaria |

| BGN |

Cyprus |

| EUR |

Denmark |

| DKK |

Germany |

| EUR |

Estonia |

| EUR |

Finland |

| EUR |

France, including French Guiana, Guadeloupe, Martinique, Réunion |

| EUR |

Greece |

| EUR |

Guernsey |

| GBP |

Hungary |

| HUF |

Ireland |

| EUR |

Iceland |

| ISK |

Isle of Man |

| GBP |

Itally |

| EUR |

Jersey |

| GBP |

Croatia |

| HRK |

latvia |

| EUR |

Liechtenstein |

| CHF |

Lithuania |

| EUR |

Luxembourg |

| EUR |

Malta |

| EUR |

Monaco |

| EUR |

Netherlands |

| EUR |

Norway |

| NOK |

Austria |

| EUR |

Poland |

| PLN |

Portugal, including the Azores and Madeira |

| EUR |

Romania |

| RON |

San Marino |

| EUR |

Slovenia |

| EUR |

Slovakia |

| EUR |

Spain, including the Canary Islands, Ceuta en Melilla |

| EUR |

Czech Republic |

| CZK |

Sweden |

| SEK |

Switzerland |

| CHF |

Yes, you can. Information and instructions for admin and VAT-return / tax-administrative processes can be found here:

| Netherlands | |

| Ireland |

The delivery address of your customers' items is irrelevant for a VAT refund. Relevant for refunding VAT is proof of export to a country outside the EU, obtained from European customs department. Alternatively, proof of import from Customs of a non-EU country is also accepted.

If export of the goods has been confirmed by Customs, a 0% VAT rate applies to the sale and you are required to refund any VAT that was paid at the time of sale.

You can read more about export and customs procedures here.

In most European countries, there is a minimum spend requirement for receipts, to be eligible for a VAT refund. This minimum spend threshold differs per country. You can check the list of EU-countries with their minimum spend thresholds below to determine if your receipt can be submitted for a VAT refund:

| Country | Minimum spend threshold in local currency | |

| Belgium | 125,01 EUR | |

| Bulgaria | 0 | |

| Cyprus | 50,- CYP | |

| Denmark | 300,- DDK | |

| Germany | 50.01 EUR | |

| Estonia | 38,- EUR | |

| Finland | 40,- EUR | |

| France | 100 EUR | |

| Greece | 50,- EUR | |

| Hungary | 50000 HUF | |

| Ireland | - | |

| Italy | 70 EUR | |

| Croatia | 740 HRK | |

| Latvia | 30,26 LVL | |

| Lithuania | 200,- LTL | |

| Luxembourg | 74,- EUR | |

| Malta | 50 EUR | |

| The Netherlands | 50,- EUR | |

| Austria | 75,01 EUR | |

| Poland | 200,- PLN | |

| Portugal | 60,- EUR | |

| Romania | 250,- RON | |

| Slovakia | 175,- EUR | |

| Slovenia | 50,- EUR | |

| Spain | 90,50 EUR | |

| Czech Republic | 1000 CZK | |

| Sweden | 200,- SEK |

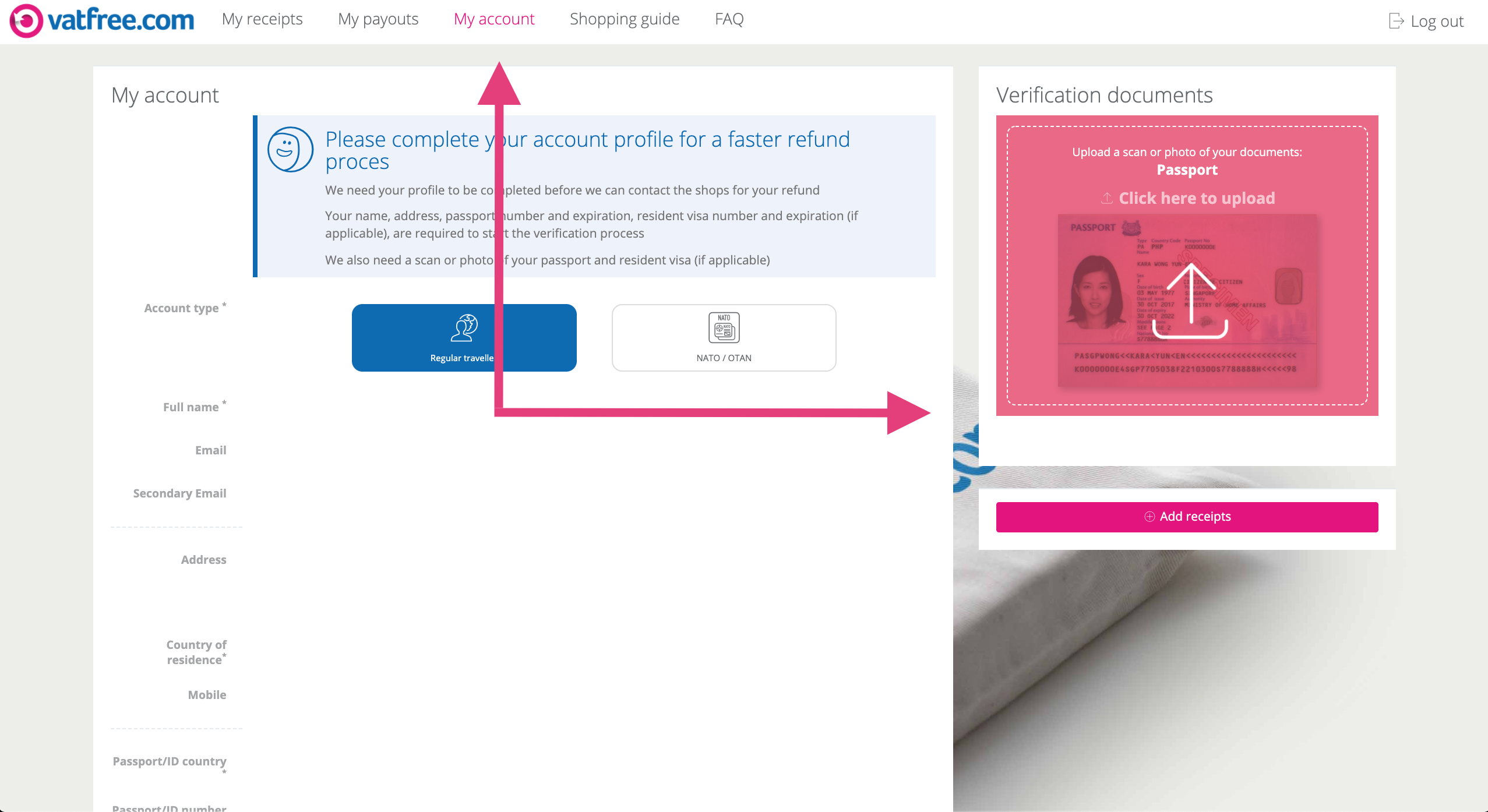

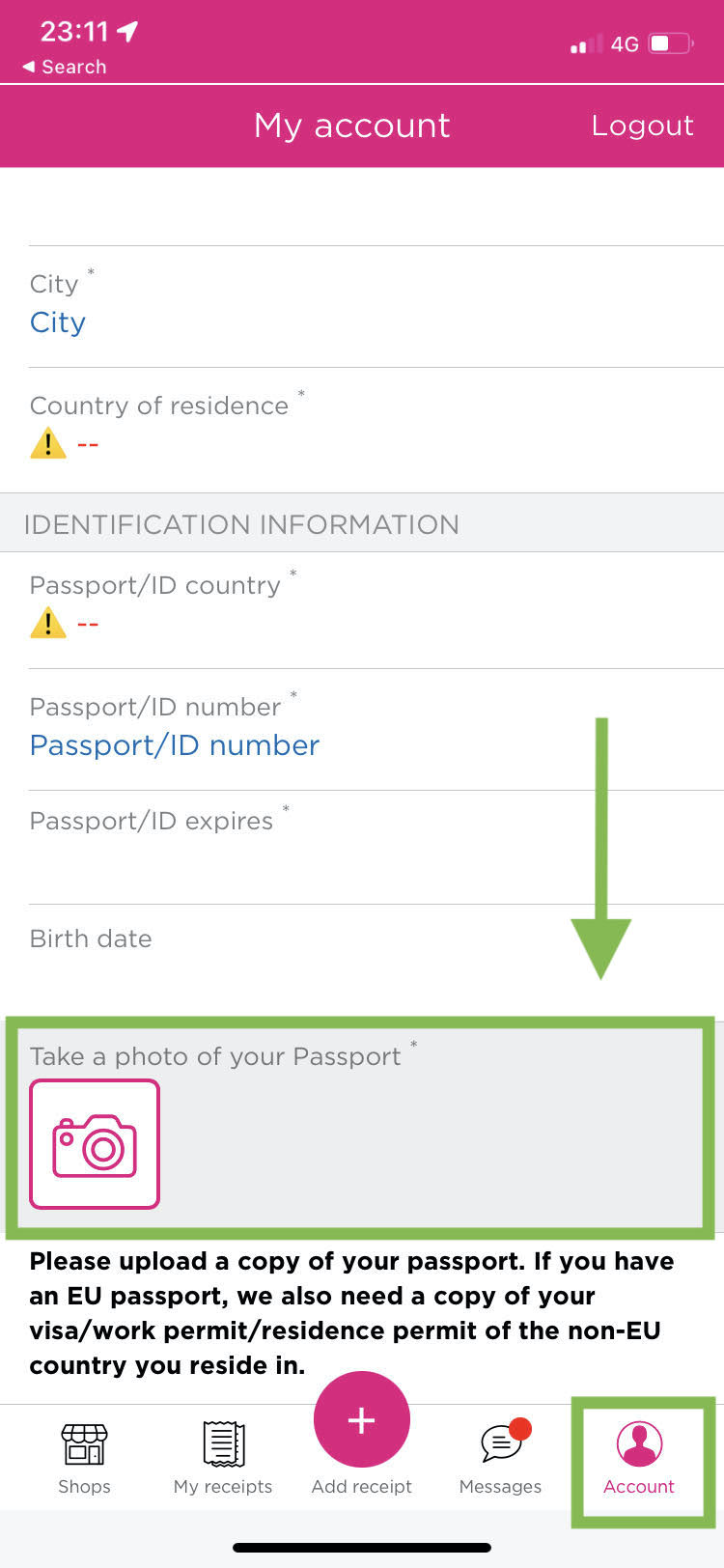

The Tax Administration requires us to store a copy of your passport for VAT compliance purposes.

Without the copy of your passport we are not allowed to process your claim. After we have received and checked the copy of your passport we can forward your claim to the store for processing.

You can read about how to safely share a copy of your passport and how we protect your identity here.

EU passport holders: If you have a EU passport, you're required to provide a copy of another document issued by a non-EU country, as proof that you live outside the EU.

The following documents are accepted as proof of non-EU residence:

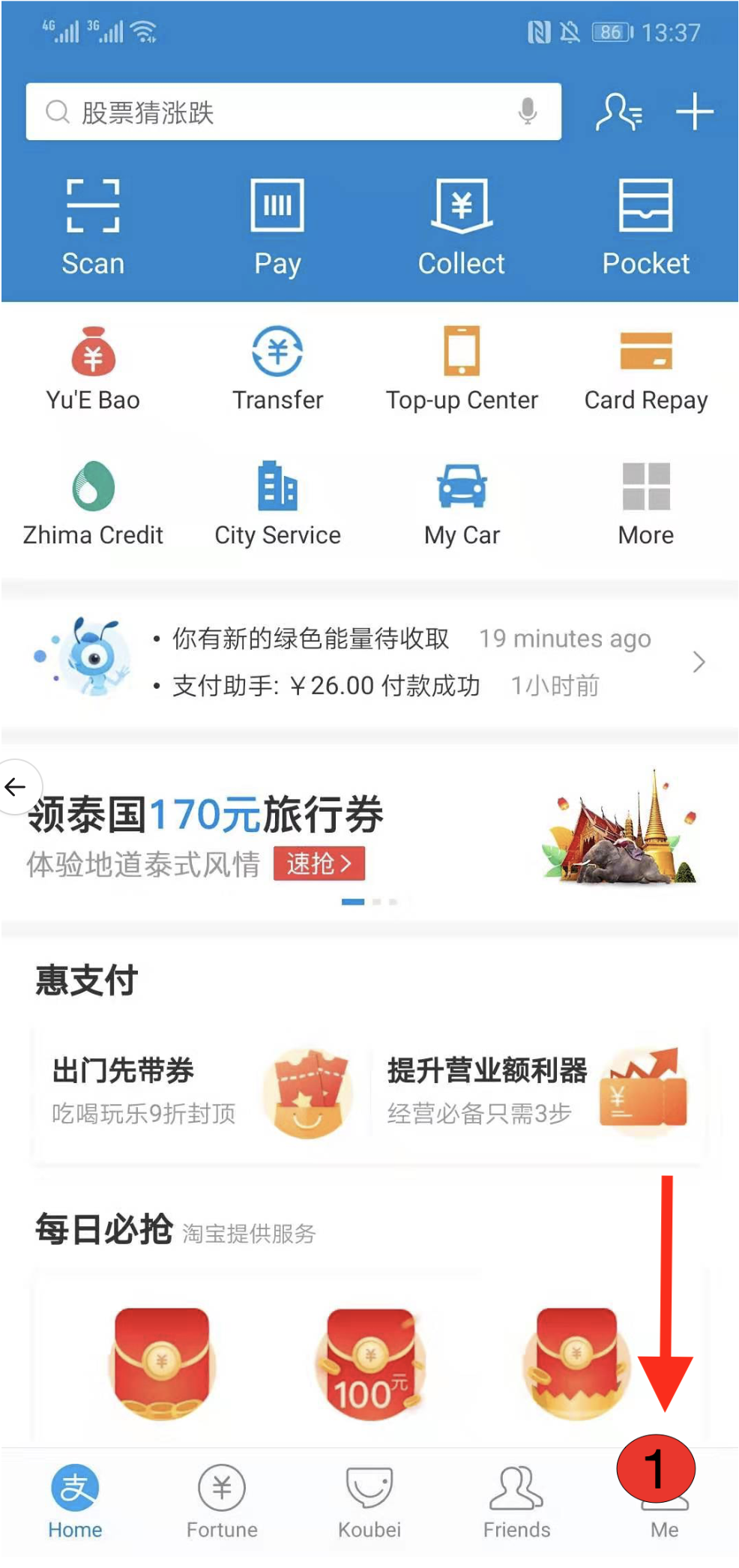

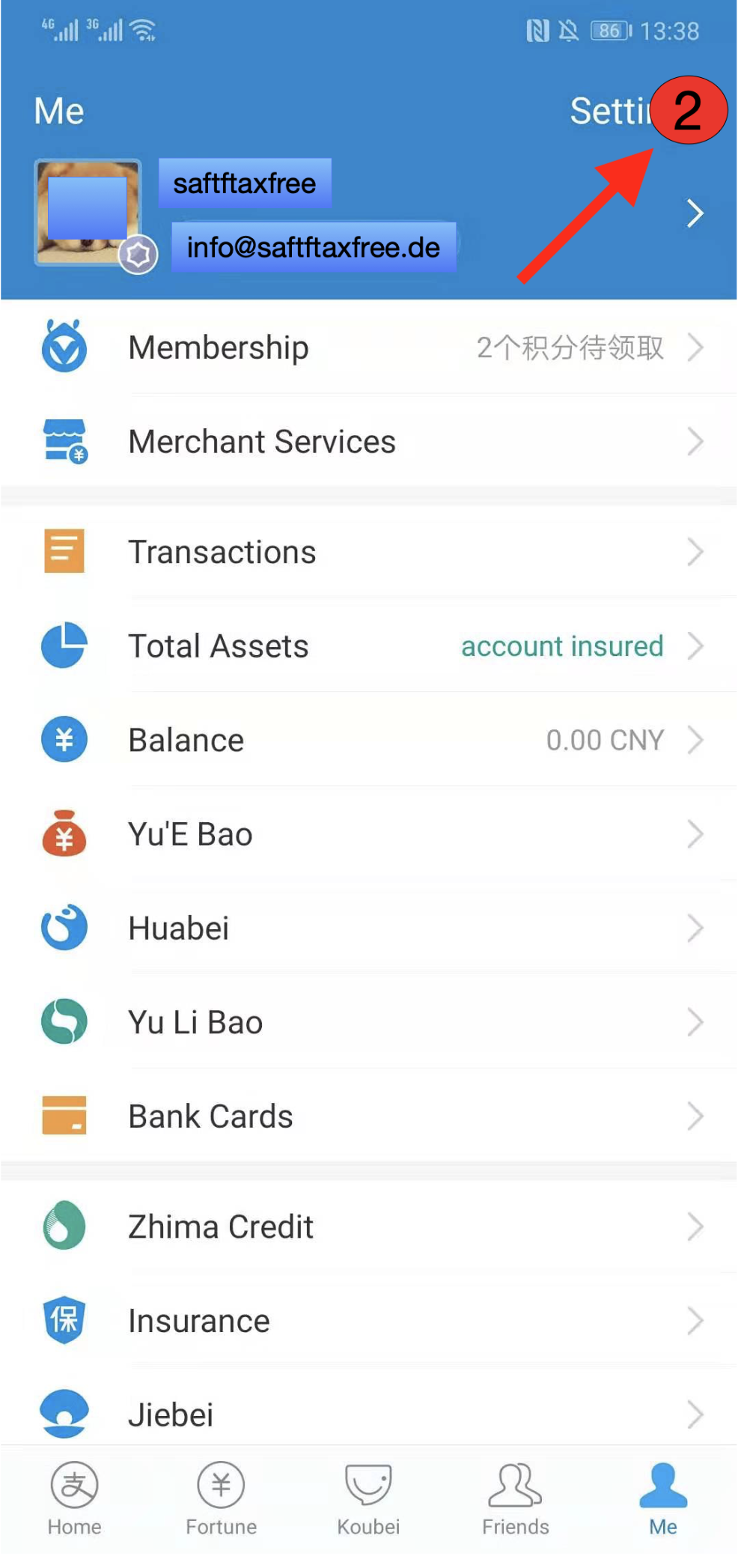

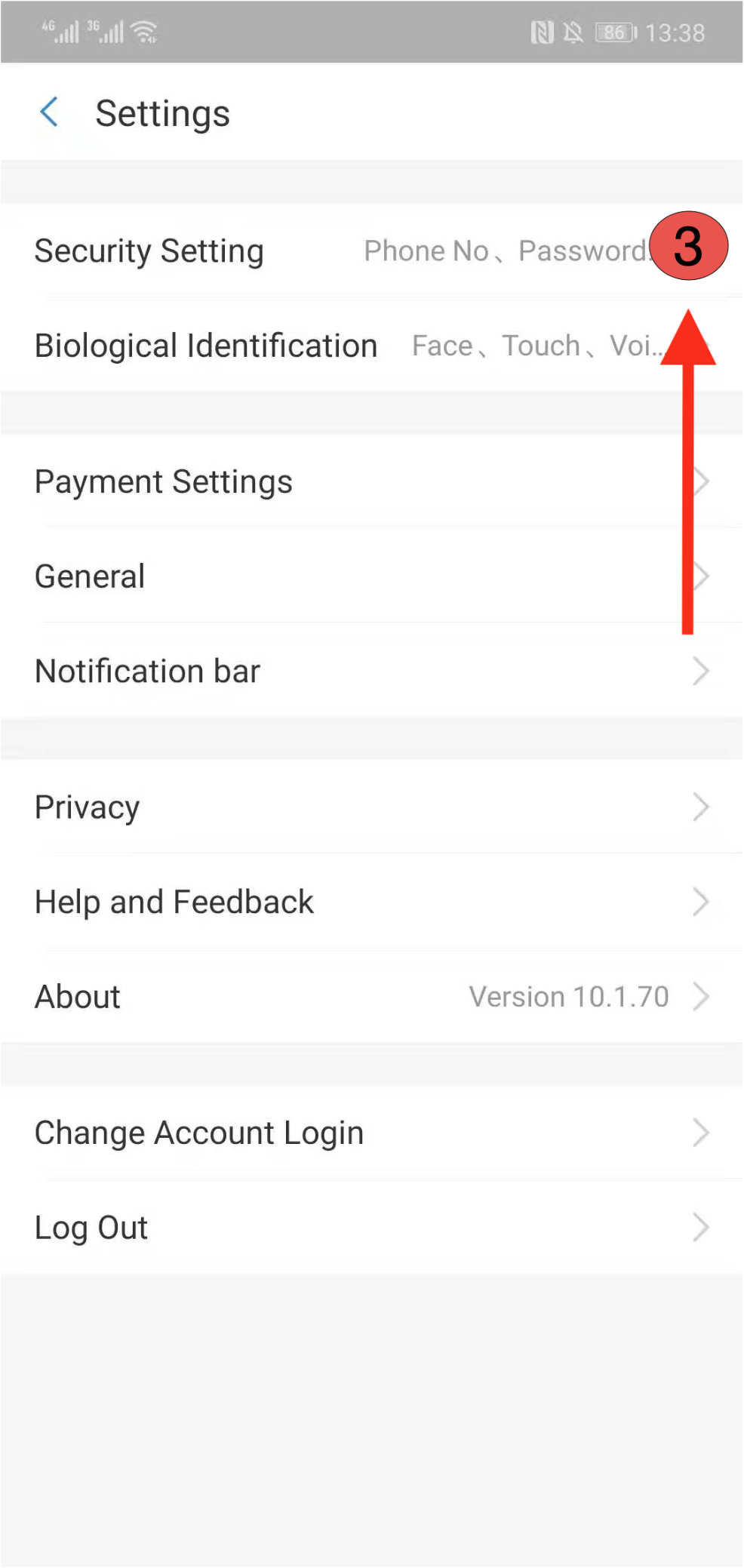

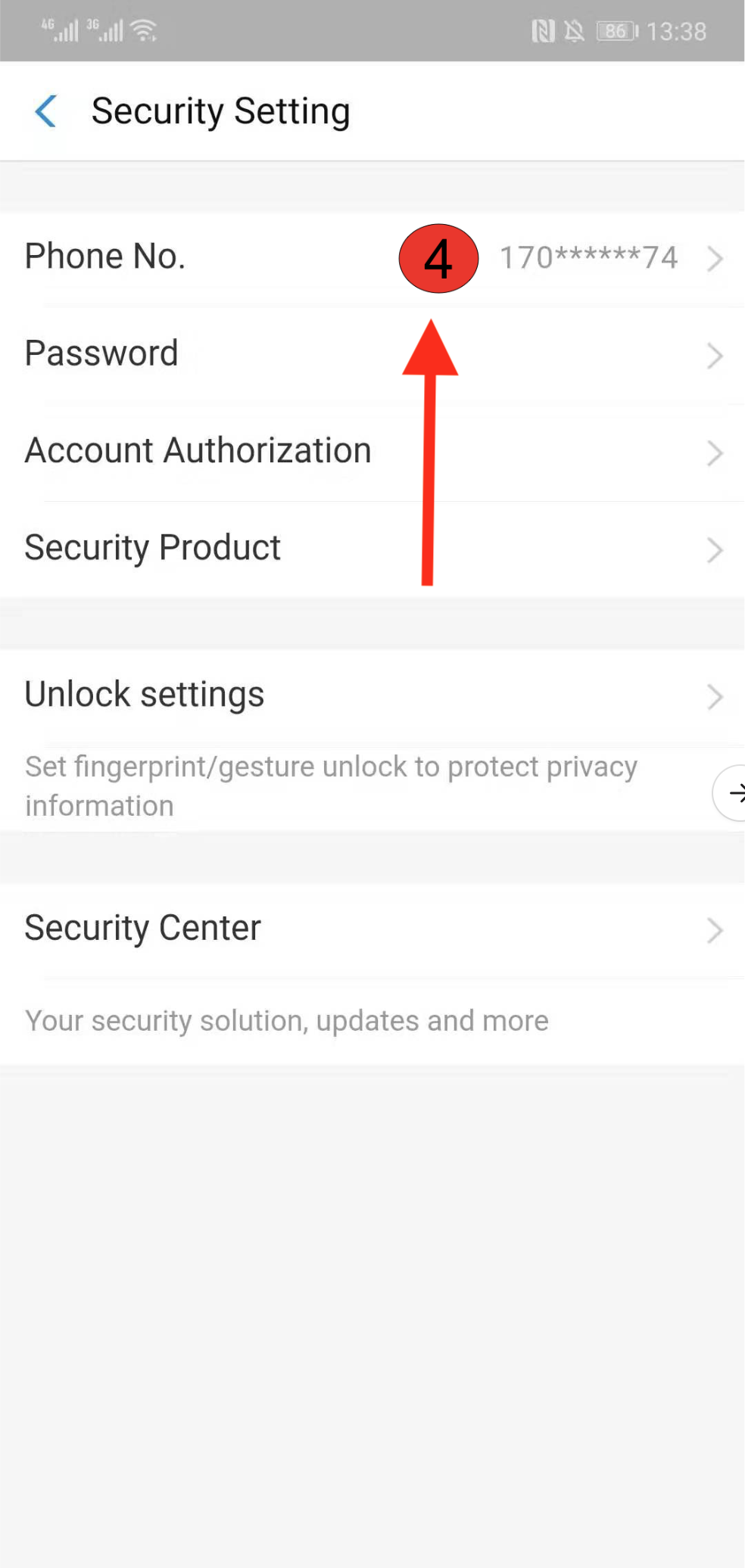

1. Go to 'Me' on your home screen

2. Go to 'Settings' in your 'Me' screen

3. Go to 'Security setting' on your 'Settings' page

4. Check your phone number on your 'Security setting' page. Your phone number is your Alipay ID.

You can find out which documents you need to submit here.

In your account, please register your claim as items that have been exported by a shipping company (ocean freighter). Follow the steps below:

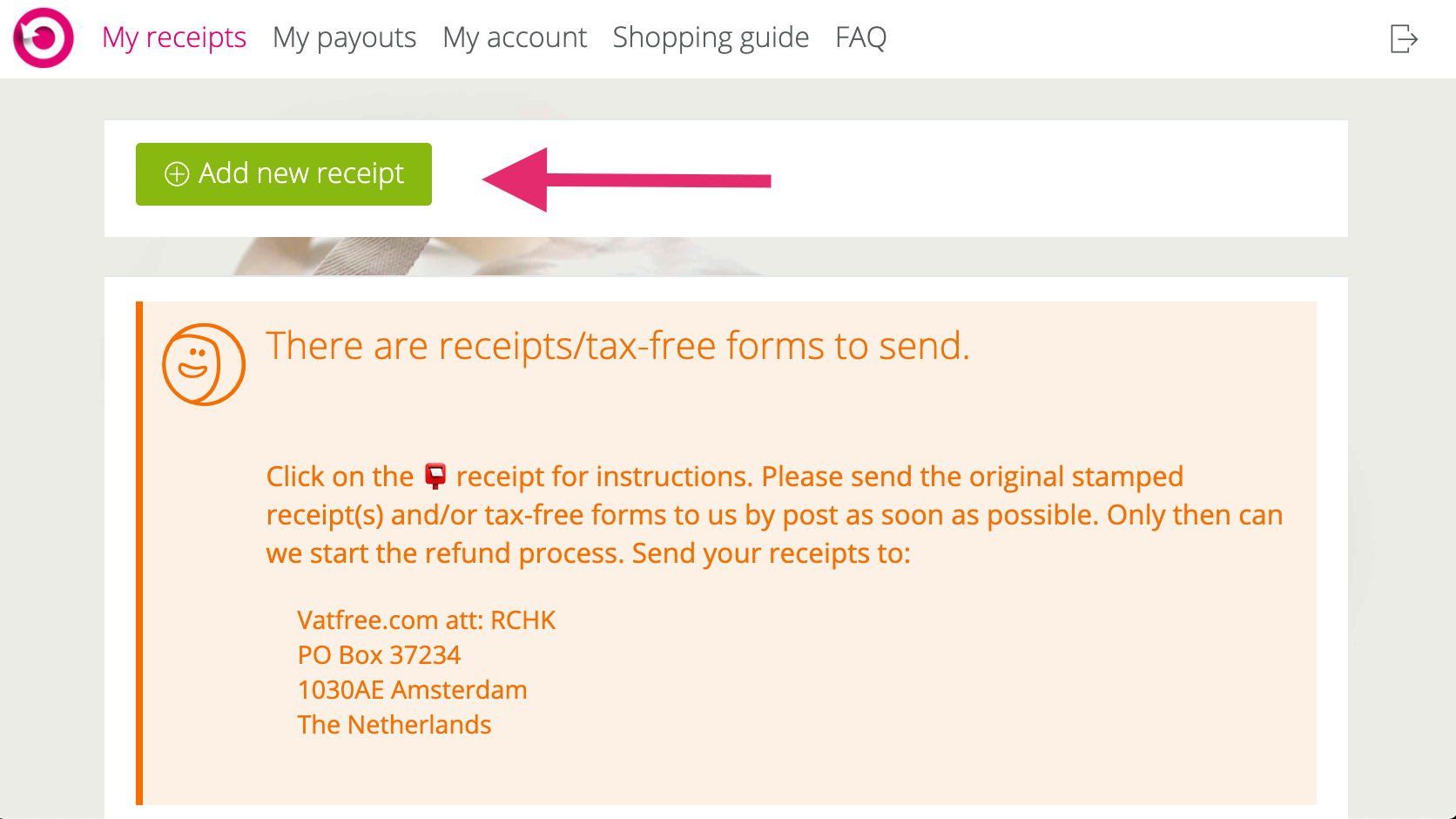

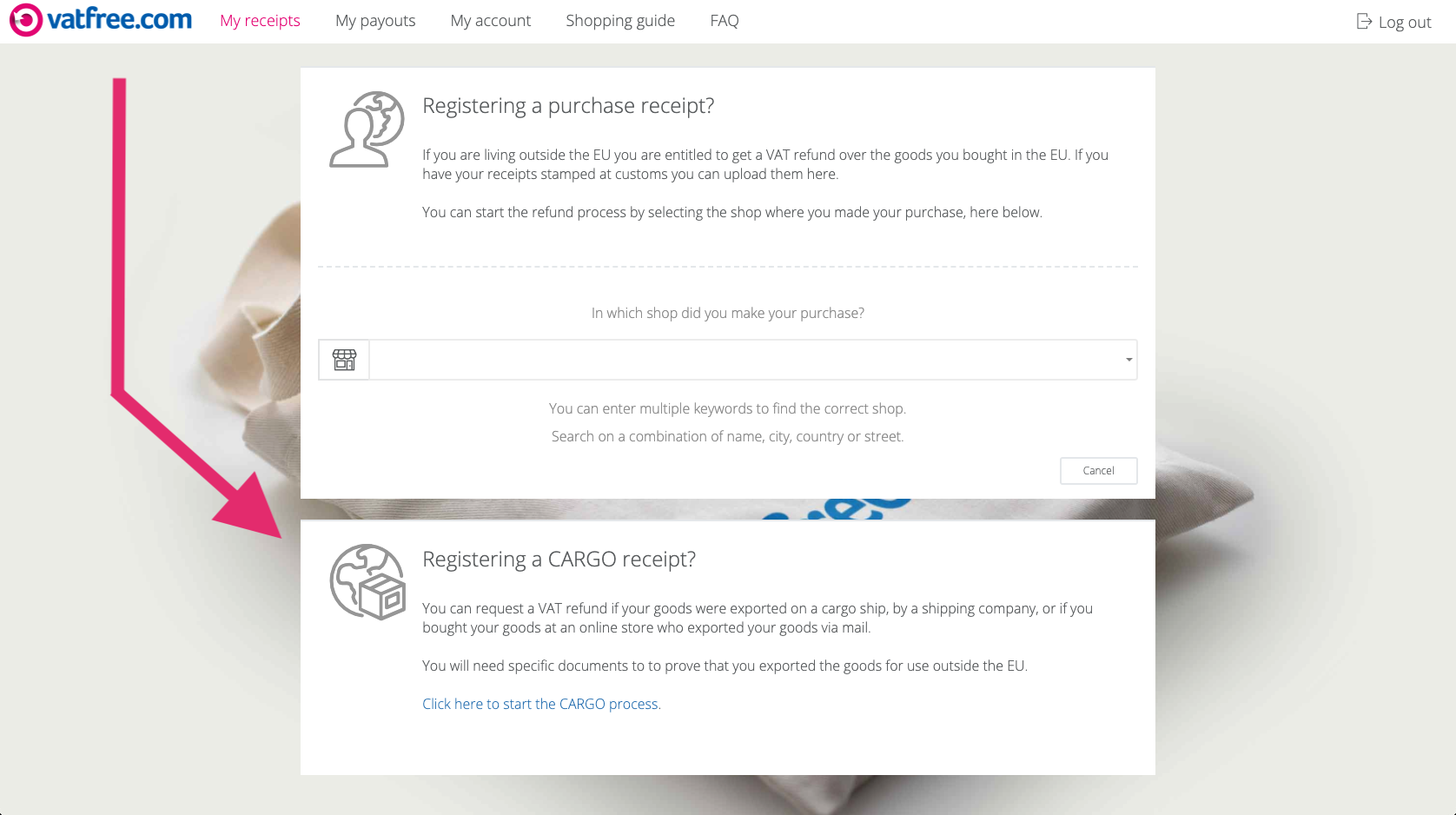

1. Go to the 'My receipts' page in your account

2. Click the green button 'Add new receipt'

3. Scroll to the bottom of the page and click the blue text 'Click here to start the CARGO process'

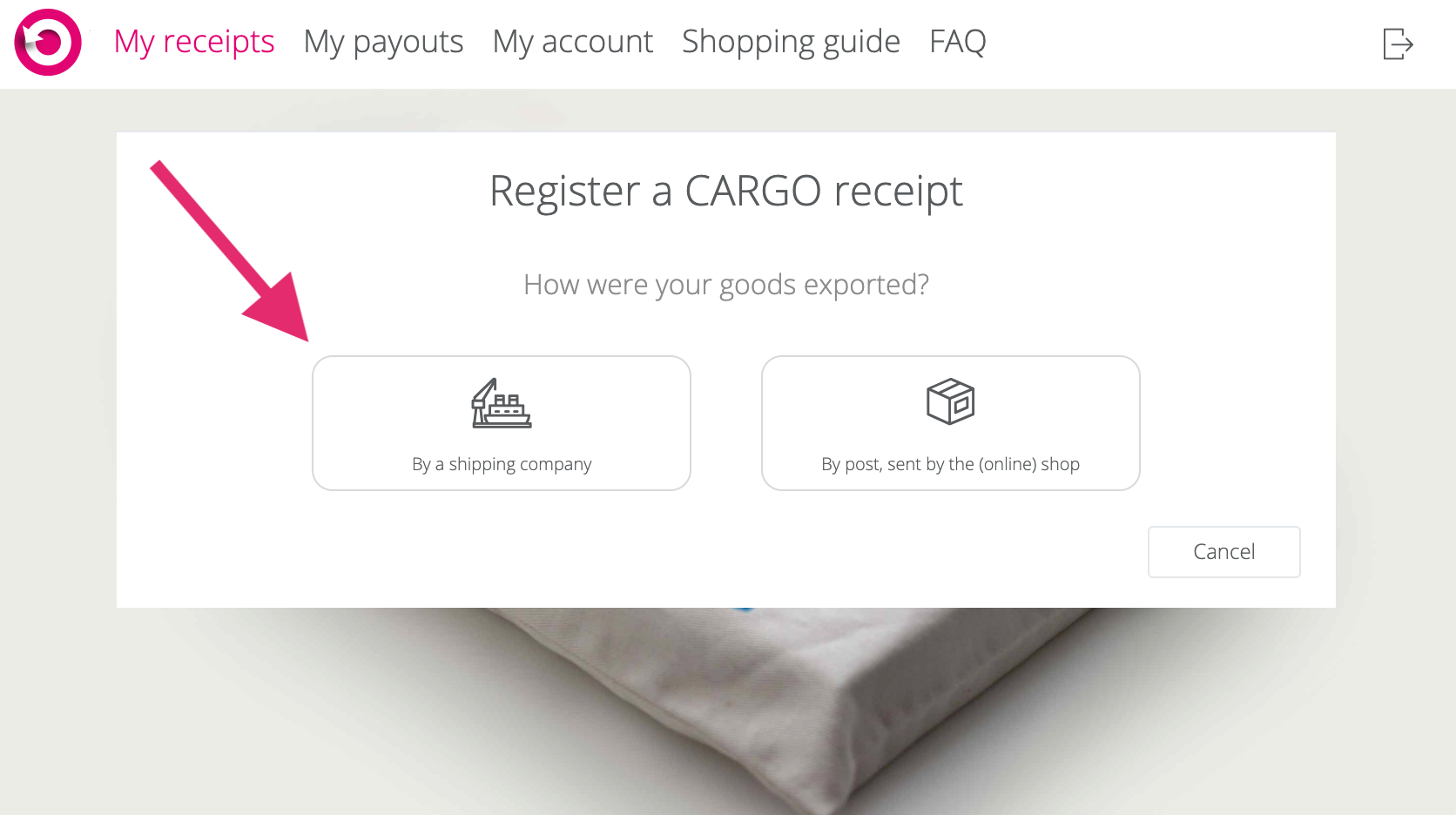

4. Select the icon 'By a shipping company'

Information and instructions for admin and VAT-return / tax-administrative processes can be found here:

| Netherlands | |

| Ireland |

Madrid Barajas Airport, Spain /

| Customs system |

|

| Minimum Spend threshold | 0 / no minimum for Spanish stores Minimum spend threshold's for other countries can be found here |

| Customs locations and opening hours | Terminal T1, Floor 1 (Check-in) Open from 07.00 - 22.00 Terminal T4 Satellite, Floor 2 (Boarding area) Open 24 hours Terminal T4, Floor 2 (Departures) Open from 07.00 - 22.00 |

| Contact details | Information points (staff members with green jackets)Phone: +34 91 321 10 00 / +34 902 404 704 Email: [email protected] |

| Required documentation for customs |

|

| Customs system | In France, you can get proof of export at digital Tax-Free (Détaxe) machines. The machine will ask you to scan the Tax-Free form which you received from the store. You can find these machines at every international airport in France. They’re usually located before check-in, in international departure halls. If the Tax-Free machine is not working or you’re departing from another EU country, go to a manual Customs desk for an export stamp. You can ask an airport employee to point you in the right direction. |

| Minimum Spend threshold | EUR 100 per store per day Minimum spend threshold's for other countries can be found here |

| Customs locations and opening hours | Terminal 1 (CDGVAL Level, Hall 6) |

| Contact details | Phone: +33 172 407 850 |

| Required for French customs |

|

Until further notice: the UK has decided to not offer the VAT refund option to tourists visiting upon leaving the EU. More info can be found here: https://www.gov.uk/tax-on-shopping/taxfree-shopping

GOV.UK

VAT and other taxes on shopping and services, including tax-free shopping, energy-saving equipment and mobility aids.

How does Tax-Free shopping work in my store? /

REGULAR CASH REGISTER SYSTEM

VATFREE.COM APP FOR POS

VATFREE.COM APP FOR iOS, ANDROID, WEB BROWSER

Customer Frequently Asked Questions:

Yes, you can submit Tax-Free forms and receipts from other Tax-Free companies, like Global Blue, Innova Tax-Free, Premiere Taxfree, Planet Payment, Easy Taxfree and so on.

Most stores offer customers freedom of choice. They might give you a Tax-Free form or receipt from a specific Tax-Free company, but they allow you to submit it anywhere (also Vatfree.com).

Thats fair, since you’re the one paying the service fee!

Unfortunately, some stores don’t want to process claims if you don’t use the tax-free company promoted in-store. In these cases, we might have to take legal action to retrieve your VAT.

✅ Before you go shopping or submit a claim, check our shopping guide to find out if a store refunds VAT on first request via Vatfree.com.

✅ Tax-free forms and receipts are part of your purchase documents. If you received these from the store, don't forget to upload copies when submitting a claim in your account.

Frequently Asked Questions

Can I get a VAT refund from any store?

What do the coloured logo's in the shopping guide mean?

How do I register a new store in your shopping guide?

Brexit: can I shop tax-free in the EU as a UK citizen? /Yes! As of 1-1-2021 you are eligible for a VAT refund when shopping in the EU. Welcome to vatfree.com!

When importing goods into the UK, you might need to pay import duties.

You can import goods up to £390 (or up to £270 if you arrive by private plane or boat). If you go over this allowance you pay tax and duty on the total value of the goods, not just the value above the allowance. You may have to pay import VAT and customs duty if you exceed your allowance.

For more information, including about alcohol and tobacco imports, please read this article here.

Where can I find a copy of my customer's passport? /Vatfree.com can share copies of your customer's ID documents on request. Requests for ID documents can be submitted via [email protected].

Vatfree.com can only share your customer's ID documents if you need them to process a VAT refund claim or in case of fiscal checks by the tax administration. We advise you to only request ID documents in case of fiscal checks. Vatfree.com stores your customers ID document copies in a safe digital environment that protects their privacy.

Passport information that is required by the tax administration to process a VAT refund claim (name, country, passport number) is shared with you automatically on your customer's digital tax free form. You can find your customer's digital tax free form in your invoice portal.

Please note that, in line with GDPR privacy laws, we are obligated to block sensitive details (photo, social security number, signature).

Where can I find my invoice? /Invoices are sent to you via email. In every invoice email you can find a link to your personal invoice portal. Your invoice portal shows an overview of all your open and paid invoices and includes your customers information and documents.

On every invoice page you can find two PDF files:

In accordance with privacy laws and regulations, your customers ID documents are not included in your invoice portal. These are stored in a safe environment and can be sent to you on request: [email protected].

If your goods have been exported via air courier (DHL, FedEx, PostNL etc) please register your receipt as a 'cargo' receipt.

Information about required export documents can be found here.

1. Add a receipt and choose the option 'register a CARGO receipt'

2. After filling in your receipt details, choose the option 'By post, sent by the (online) shop'

3. Upload your 'Confirmation of shipment' and 'POD'. You can find more information about these documents here.

Currently the customs desk at Schiphol airport is still operating as usual.

Location: departure hall 3, before the check in desks and passport control.

Opening hours: 06:00 – 22:00

If there is nobody at the desk during opening hours you can call the following number: +31881583900

If you visit the customs after opening hours, you can call the night shift. A customs officer will come down to the customs desk to stamp you receipts. Please call 15 minutes in advance. This service is available 24/7.

Telephone number for the night shift: +31881583440

You can also go to customs at the airport in your non-EU homecountry of arrival.

Some individuals are currently stuck in the EU due to the Coronavirus outbreak and this prevents them from getting the customs stamp on time.

Currently it is not yet clear wether customs and tax administrations will provide exceptions for these cases. We have contacted the Dutch customs and tax administration and they are aware of the situation. The issue will be discussed internally.

Currently you are advised to go to customs at your earliest convenience, also if you are already late, and explain your situation to the customs officer. If you have a flight itinerary that shows a booked and missed flight due to flight restrictions please bring this with you to customs.

Are you unable to print Vatfree.com Tax-Free receipts or are you experiencing other problems with the Vatfree.com app on you POS?

Please contact us:

To upload a copy of your passport, you need to be logged in to your account. You can upload a copy of your passport on your account page.

When you are logged in via the app and on your account page, scroll down to upload a copy of your passport:

When you are logged in via the website and on your account page, you can upload a copy of your passport on the right side of the page:

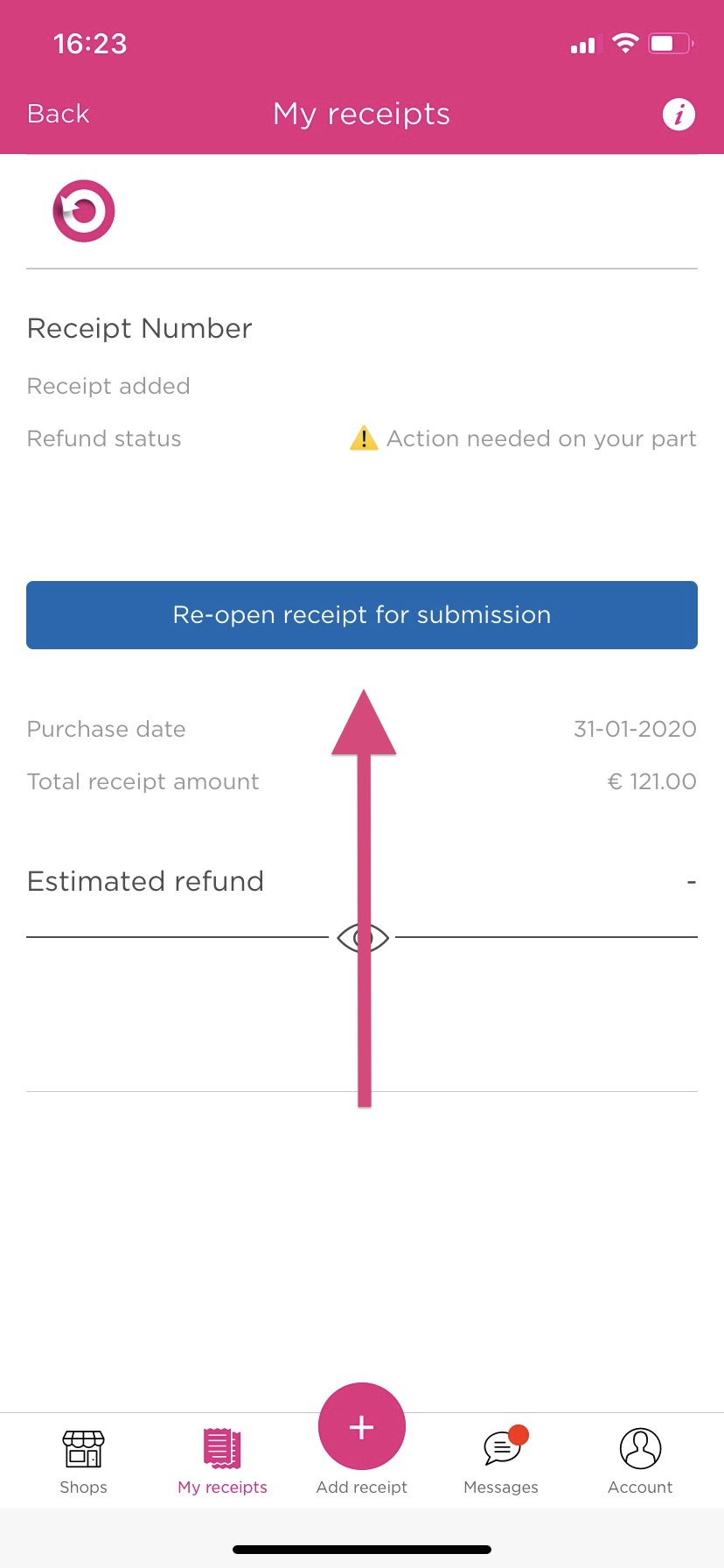

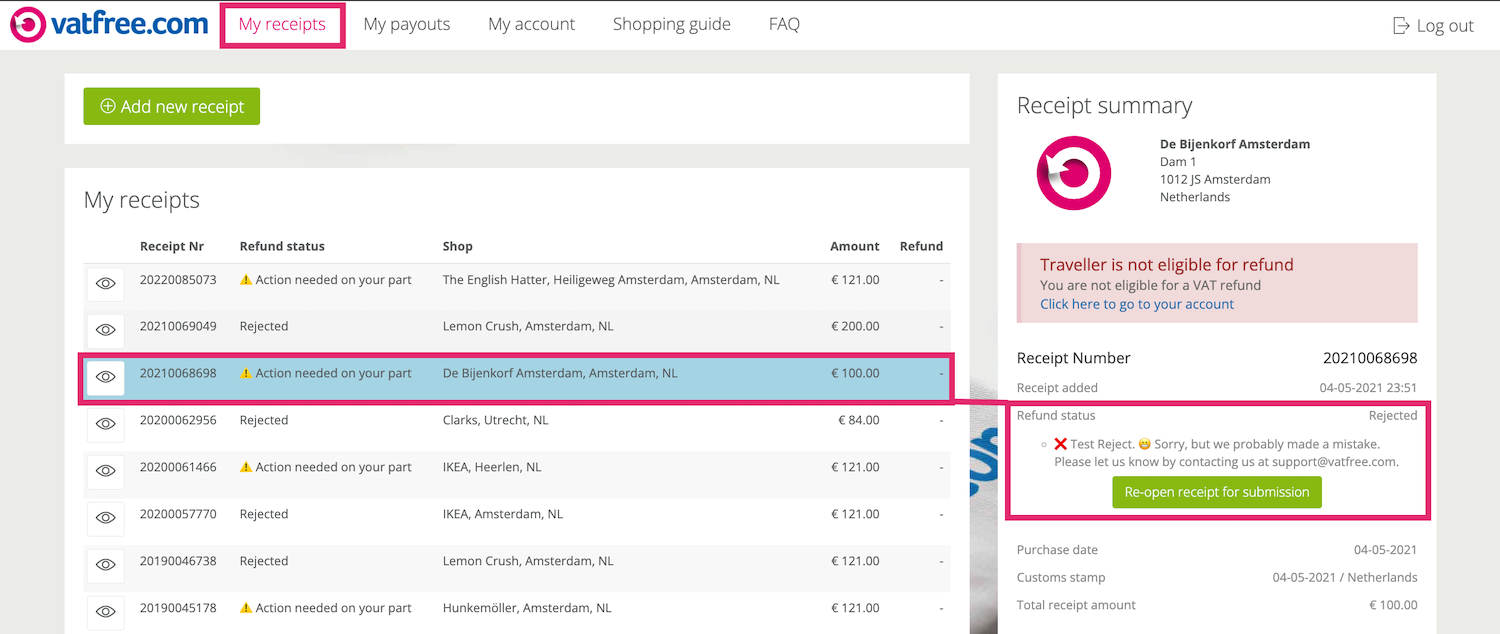

First, check the email we sent you to let you know your receipt has been rejected. In this email we let you know why your receipt has been rejected and what you can do to fix it.

If your receipt can be re-opened for submission you will see a blue button on your receipt page 're-open receipt for submission'. Click this button to re-open your receipt, to add any missing documents.

If you do not see any button to re-open your receipt for submission, let us know by email and we will check if we can help you further.

You can add a copy of your boarding pass when you're registering a receipt. You will see an option to upload the copy of your boarding pass. You can also upload a copy of your flight itinerary instead.

Make sure your name and date of exit from the EU are clearly visible.

No. Companies can not submit VAT refund claims via vatfree.com. If you want to submit a VAT refund claim via vatfree.com you can only do so as a private person.

The tax administration does not allow us to process business claims. To comply fully with tax-administration requirements we therefor can not process receipts and invoices showing company names and/or VAT numbers (other than those of the seller).

Are you buying for a European business? More information about VAT refunds for European businesses can be found here:

You may also contact your local tax-administration, tax-advisor and/or accountant for help and information about how to submit a claim.

Why vatfree.com? /Our mission is to help travellers easily shop tax-free at stores and brands that love them back.

To do that we offer the easiest online and mobile service, to the most diverse group of customers, for the highest refund guaranteed.

Why mobile? With airports requesting travellers to show up at least three hours before their flight, and safety procedures taking up a lot of time, most travellers have little time left to arrange getting a Customs validation stamp on their receipts. Standing in line at Customs may take up to half an hour or more. Being required to then stand in line at a desk for a cash refund, can increase the time of this entire process to an hour or more. Time is spare so we built the first ever tax-free shopping app in 2016, so travellers can finalise the refund claim once they find a spare moment, on the plane home or in the comfort of their own house.

Why diverse? We are the first and only tax-free shopping service founded by travellers, specifically for travellers, with a main focus on travellers' needs. Our service therefore ranges from helping a range of travellers from tourists, cruise passengers, military staff, expats and international students. We also are able to help travellers get back VAT over shopping made online, offline, cross border, over purchases charged with low as well as high VAT rates at shops that are either listed in our shopping guide as well as not listed and new to us.

Why the highest refund guaranteed? The most common feedback we get from travellers is that they feel uncomfortable being subjected to high fees for claiming back Value Added Tax they are entitled to. Especially after having to go through so much effort to arrange the refund. We get that. Regulation states that when exporting goods to a non-EU country, you do not have to pay VAT. For travellers to claim back the initial paid VAT, they have to stand in line at Customs, before flying back home, to get proof of the export. This can be quite stressful, take up quite some time and in some occasions even lead to missing out if queues are long and you have to catch a plane. Once the stamp is collected, the only way to claim back VAT is to contact the shop. If the shop is unwilling to cooperate, charges high fees (with or without a tax-free partner) or just takes a long time to process it all, this leads to disappointment and a feeling of dispair. Traditional tax-free shopping companies charge fees varying from 35% to 50% of the VAT amount and are only an option if shops are affiliated. We decided to use today's technology to create an open platform for all shops to easily join, without necessary contracts, and to minimise costs in such a way that we can continue to offer the highest possible refund. Our service fee starts at €2,50 per receipt with a maximum of €80. With this we hope to have helped retailers and shops as well as we believe a happy customer is a customer for life.

We would love you to join us and list your shop(s) in our shopping guide free of charge: click here to join.

Whether you need a Tax-Free form depends on the Customs rules of the EU country you're departing from. Different rules apply in different countries.

Good to know:

✅ Check our country guide to see the Customs rules per EU country

✅ In most EU countries, Customs requires an invoice which meets the requirements for a VAT refund

✅ Many stores will give you a Tax-Free receipt or Tax-Free form as a replacement of an invoice. Tax-Free receipts and Tax-Free forms are valid replacements and are accepted by all Customs departments in the EU

✅ If the store can't print a proper invoice and doesn't have Tax-Free receipts or forms, you can download one here. Attach it to your purchase documents from the store.

⚠️ Received Tax-Free receipts and Tax-Free forms from a different Tax Refund company (other than Vatfree.com)? Check our shopping guide to confirm you can submit them via Vatfree.com

⚠️ In Spain and France, Customs want a Tax-Free form issued specifically by the store. The VAT is refunded by the Tax Refund Operator visible on the form. You can't print your own Tax-Free form. Without a form from the store, you can't get back the VAT.

There is currently no option to get a customs stamp at Amsterdam Central train station. Customs is no longer located there.

If you are leaving The Netherlands from Amsterdam Central station by Eurostar to the UK, please contact [email protected] to explain your situation. Kindly attach copies of your purchase receipt and Eurostar ticket to your email.

Our service is fully digital which means we can't pay your refund in cash.

You can find our list of payment options here.

If you are a member of a diplomatic mission or consular post based in the EU, you need a certificate of VAT exemption (151 form) to get a VAT refund. Please contact your institution's tax department for more information about where to get a form.

⚠️ British Diplomats can not get back VAT on purchases made in Belgium

Vice versa, Belgian Diplomats can not get back VAT on purchases made in the UK. For more information please contact [email protected].

⚠️ For items purchased in Belgian stores:

You must contact a Tax-Refund Operator licensed by the Belgian Ministry of Finance to process VAT refund claims for Diplomatic purchases. Licensed parties include Nuvoni and Forax.

✅ Individuals working at VAT-exempt institutions in the Netherlands:

Certificates for VAT exemption for individuals working at VAT-exempt institutions in the Netherlands can be obtained from Team IFB. Email: [email protected]

Customs system

➤ Manual customs desk: stamp, for receipts from all EU countries

➤ Digital customs machine: barcode scan, only for receipts from the Netherlands

Minimum Spend threshold

EUR 50 per store per day for Dutch stores.

Minimum spend thresholds for stores in other EU countries can be found here

Customs locations and opening hours

Departure hall 3 (before check-in and security)

Desk open from 06:00 – 22:00

⚠️ Customs officers are present at the airport 24/7

If the desk is closed, you can contact customs via the numbers below (also displayed on the customs desk). A customs officer will come to stamp your receipts.

Contact details

+31881583900 (6:00 am - 10:30 pm)

+31881583440 (10:30 pm - 06:00 am)

Required for customs ➤ Any purchase document showing your name, non-EU country of residence and passport number (can be a regular receipt, invoice or Tax-Free form) ➤ Purchased items ➤ Passport ➤ If you have an EU passport; proof of residence outside the EU ➤ Boarding pass

Please pay attention to your layover time. If you have a layover of 2 hours or more at another EU airport before exiting the EU, customs at Schiphol will not stamp your receipts. They will redirect you to customs at your layover destination.

Short layover (1 - 2 hours)

Customs will stamp your receipts at Schiphol if the layover at your next EU airport is no longer than 2 hours.

Long layover ( 3 hours or more)

If the layover at your next EU airport is 3 hours or longer, customs at Schiphol will redirect you to customs there.

You can get a stamp at Schiphol airport if your luggage can be checked in to your final non-EU destination directly. Go to customs before checking in your luggage. A customs employee will accompany you to check in your goods and luggage before stamping your receipts.

If the online store delivers your items to an address inside the EU first, and after that you export the items via ocean freighter yourself:

After, we'll provide a time-frame for your refund and notify you when your VAT has come in from the store.

Information about payment methods can be found here.

Shopping online and exporting via airplane, car or train /If the online store delivers your items to an address in EU and you later export the items via airplane, train or car:

Step 1. Non-EU billing address

When you pay online, most webshops provide the option to fill in a delivery address and a billing address. For the billing address, use your non-EU address and if possible, insert your passport number in an address line.

If your invoice does not show your non-EU address, we advise you to print a Tax-Free form for customs. This is required in some EU countries (not required in the Netherlands).

Step 2. Print your invoice from the store Most online stores send your invoice via email after you have paid.

Step 3. Get proof of export

You can find out where to find customs here.

After passing by customs, make photos/scans of all your documents and upload them to the Vatfree app.

When we have approved your documents, we'll provide a time-frame for your refund and we'll notify you when your VAT has come in from the store.

Information about payment methods can be found here.

If the online store organised delivery and export of your items to an address outside the EU:

After completing this process we'll keep you updated by email automatically. We'll provide a time-frame for your refund and we'll notify you when your VAT has come in from the store. Information about payment methods can be found here.

ONLINE → store delivers directly to non-EU address → exported via courier (DHL, UPS, FedEX etc) /If the online store delivers your items to an address inside the EU first and you then export the items yourself via courier like DHL, UPS, FedEX or another postal forwarding company;

After completing this process we'll keep you updated by email automatically. We'll provide a time-frame for your refund and we'll notify you when your VAT has come in from the store. Information about payment methods can be found here.

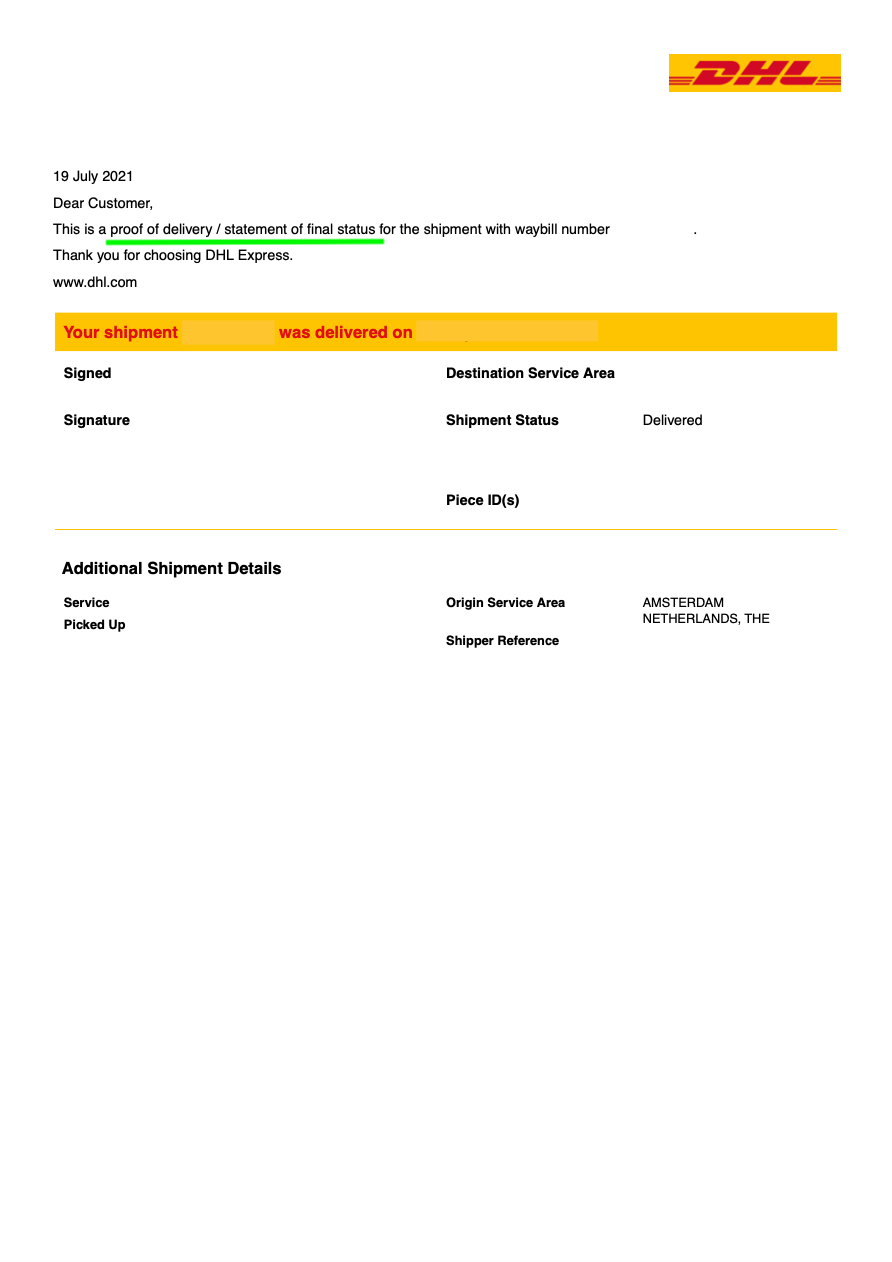

What documents do I need for items exported by air (DHL, FedEx, PostNL etc) /Your shipping documents must be issued by your shipping company and show sufficient information about your purchase from the store:

| DOCUMENT | MANDAORY INFORMATION |

Air Waybill (AWB) or Commercial Invoice |

When creating an AWB and invoice for your shipment, you can include the transaction nr. from the store in the sections 'shipment details' and 'full description of goods' |

Proof of Delivery (POD) |

|

You are eligible for a VAT refund if you meet the NEMS-requirements:

N: you are a non-EU resident and purchase goods in the EU for personal use in your non-EU homecountry

E: you export the goods to your home country before the end of the third month after the month of purchase

M: you spend a minimum amount per shop, per day

S: you have received a stamp from customs on your receipt, either at EU-customs or at a customs office upon arrival in your home country

Please note; there are also requirements for purchase receipts.

Using Vatfree.com API for POS integration is simple and convenient if your point-of-sales provider partners with us.

Our Current POS Partners:

To activate the Vatfree.com API, contact your POS account manager and cc [email protected]. Note that some POS companies may charge a small setup fee or monthly data management fee.

If your POS provider isn't listed, email your POS account manager to request an integration setup and cc [email protected]. We're here to assist with any questions they may have.

As an alternative to our API, you can also use our free In-Store app for iOS and Android. Make sure to let us know on [email protected] or +31 88 828 3733 so we can adjust your account settings for access.

Can I submit my claim directly to the store? /Yes, you can, but most stores won't process your individual claim. Many stores that do process individual claims charge a fee, just like vatfree.com. Why? Because, in order to process VAT refund claims submitted by consumers, stores need to carry out administrative procedures that are more complicated than usual. They also need secure environments to store customer's data and ID documents. Many stores don't know how to do this themselves and don't want to invest time and money into internalising the required know-how. Instead, they prefer to outsource this administration to (you guessed it); tax-free providers like vatfree.com. Processing claims submitted via vatfree.com isn't only easier for stores, it's also easier for you. After all, it takes a lot of your precious time to submit claims to each individual store and keep track of all that communication. Vatfree.com offers the highest refund in the market. So why not outsource your admin to us, instead of doing it all yourself!

Why do I pay a service fee? /We guarantee the highest refund in the market as our service fees are the lowest. And we're proud of it! If you find a lower service fee somewhere else, let us know and we'll match it, guaranteed.

At Vatfree.com, you pay:

--------------------------------

To process a VAT refund claim, among other things, we need to:

The costs associated are reflected in our fees.

It's our mission to get fees close to zero (0).

We're continuously innovating in order to make that happen. Developing the tech requires funds and getting all stores, Customs departments and Payment Solution Providers on board takes time.

In the mean time, we try to offer the lowest service fees as possible and we're proud of that. If you find a lower fee somewhere else, please let us know. We'll match it, guaranteed.

Frequently Asked Questions: How do Vatfree.com fees compare to other Tax-Free companies?

What if I find a lower fee somewhere else?

What is the Vatfree.com service fee?

Vatfee.com refund calculator

This article applies to NATO military employees stationed in the Netherlands that have bought items in stores outside the Netherlands (but inside the EU)

To submit a VAT refund claim, please follow the steps below:

Get a purchase receipt or invoice from the store

Print and fill a 'VAT and Excise Duty Exemption Certificate 151', two (2) times. One (1) for yourself and one (1) for the tax office. The tax office will not make copies; you have to have both copies with you. Download: GENERAL 151 FORM

Box 1: Fill in YOUR name & YOUR Netherlands' residence address (ignore Brunssum address)

Box 5: Fill in the store details, description of your items (like on your purchase invoice) and item amounts excluding VAT

Box 2, 3, 4, 6, and 7: will be completed and stamped by an employee at the tax office.

Download our app or create an account via our website and register your receipt. We’ll ask you to upload copies of your documents.

When this process has been completed, we’ll check your documents and contact the store for your refund. You’ll be notified by email when a store has processed your claim. After receiving notification, payment can be requested by logging in to your account.

Additional remarks:

If you are stationed in the Netherlands and buying at Dutch stores, please follow instructions here.

To submit a VAT refund claim, please follow the steps below:

Get a purchase receipt or invoice from the store

Print and fill a 'VAT and Excise Duty Exemption Certificate 151', two times.

One (1) for yourself and one (1) for your NATO base admin/tax office. The tax office will not make copies; you have to have both copies with you.

Box 1: Fill in YOUR name & YOUR residential address in the EU

Box 5: Fill in the store details, description of your items (like on your purchase invoice) and item amounts excluding VAT

Box 2, 3, 4, 6, and 7: will be completed and stamped by an employee at your NATO base admin/tax office.

Download our app or create an account via our website and register your receipt. We’ll ask you to upload copies of your documents.

When this process has been completed, we’ll check your documents and contact the store for your refund. You’ll be notified by email when a store has processed your claim. After receiving notification, payment can be requested by logging in to your account.

Additional remarks:

Which documents are required from you will depend on the country and the base you are stationed in/at. Please confirm with your NATO base tax office for more information about the required documents.

| NATO BASE/COMMAND | REQUIRED DOCUMENTS |

JFC Brunssum, Netherlands |

Detailed instructions here |

Most other NATO bases in the EU (please contact your NATO base tax office to confirm) |

|

To submit a claim for items exported by post (DHL, FedEx, PostNL etc) you don't need a stamp from customs. Instead you'll need to provide three (3) documents. The 'commercial invoice' is one (1) of them.

EXAMPLE:

.png)

Information about other required documents can be found here.

A Proof of Delivery (POD) is a document which the receiver signs when a shipment is delivered in good order and condition. The POD usually contains:

The POD can be found on your shippers website by using your tracking number. Track your shipment to download your POD here;

EXAMPLE:

For shipments from the Netherlands to countries outside the EU, we advise you to contact Morends Logistics.

Morends is a professional logistics company offering international shipping via sea freighter and air courier (DHL, UPS, FedEx, etc). They will provide all the required documents for export via ocean and air.

Please contact Morends for information about shipping costs. Shipping costs are to be paid separately to Morends and are not included in the Vatfree.com service fee.

You can find your receipt status in your account by going to your 'my receipts' page and selecting a receipt. The status of your claim is visible in the receipt summary:

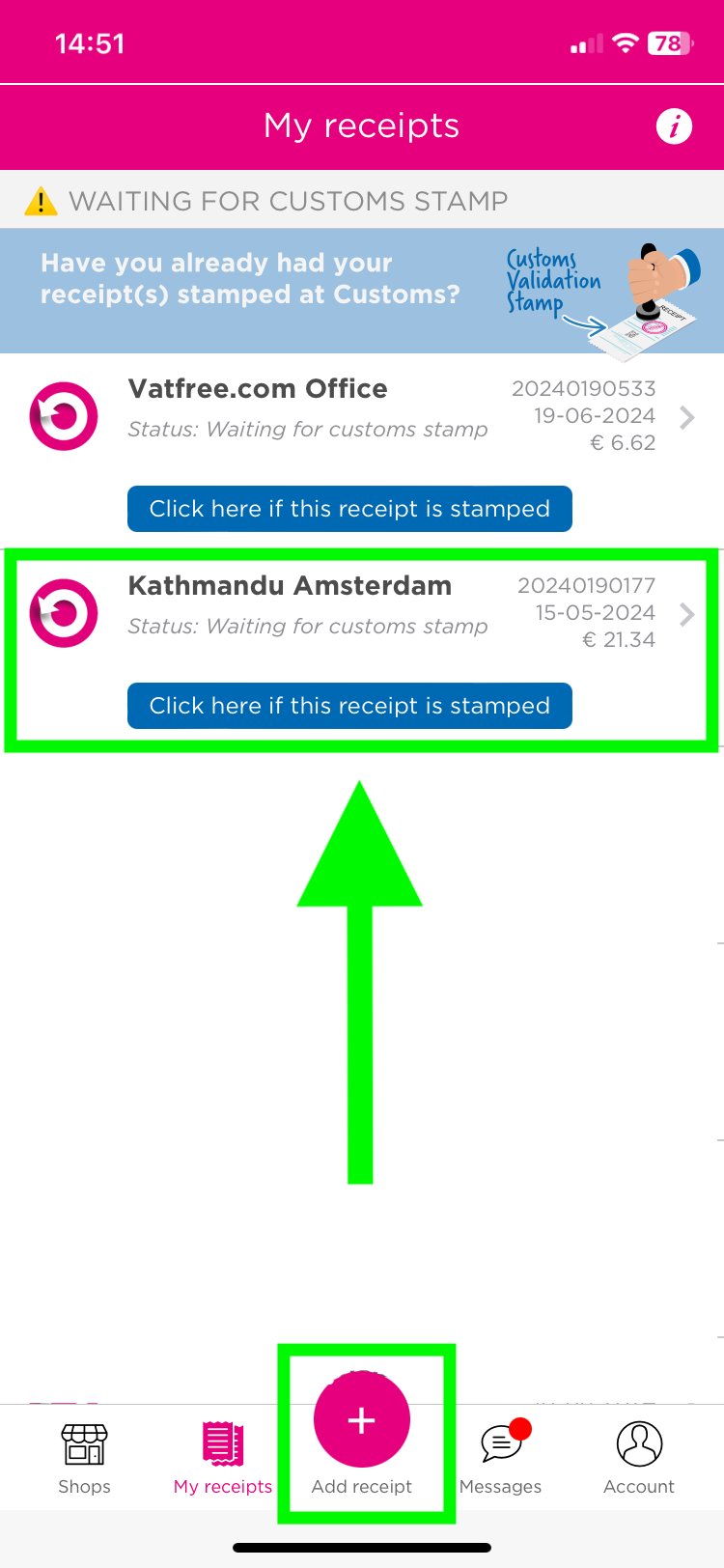

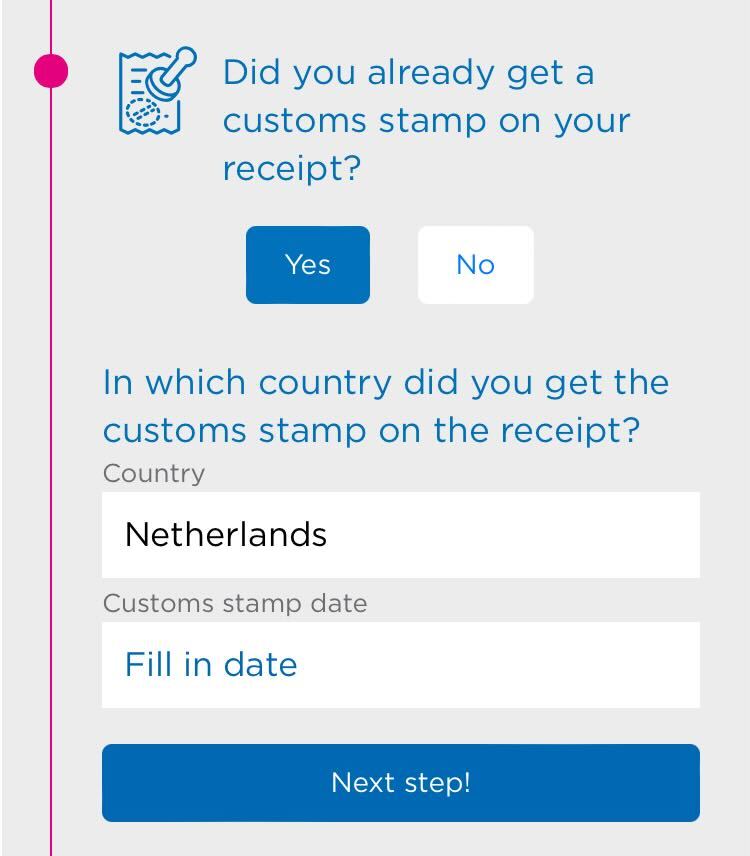

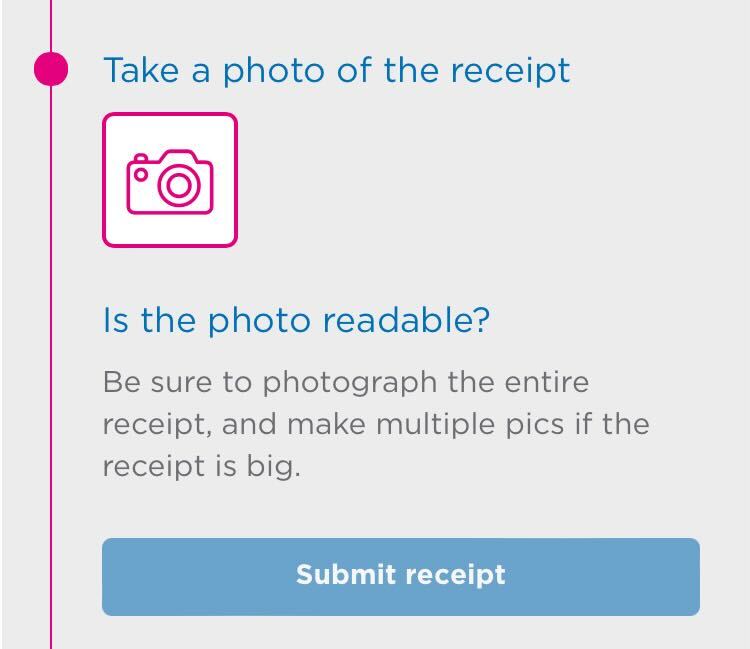

| Refund Status | Meaning |

| Waiting for customs stamp | You still need to mark your receipt as ‘stamped by customs’. Select your receipt → upload a photo of your receipt with the customs stamp visible → click the blue button ‘stamped by customs’ |

| Waiting for traveller verification | We still need copies of your ID documents before we can continue processing your claim, or your ID documents are still being checked. You can upload your ID documents on your account page. Your ID documents will be checked within 24 hours. |

| Send original receipt by post | We need to receive your original receipt by post in order to process your claim. You can find our postal address here. |

| Waiting for visual validation | We have received and accepted your receipt. It’s now being checked by a member of our staff. Your receipt will be checked within 24 hours. |

| Waiting for double-check | Your receipt needs to be double-checked by a member of our staff. Your receipt will be checked within 24 hours. |

| Rejected | Your receipt can (currently) not be processed for a VAT refund claim. We will let you know why your receipt was rejected via email. The reject reason will also be visible under the receipt status in your account. Go to your 'my receipts' page and select the receipt to see the reject reason. |

| Waiting for shop validation | The store where you bought your items is new in our system or needs to be updated because it hasn't received a claim in a very long time. We’re in the process of contacting them to receive information about how to submit your claim to their administration. |

| Ready for invoicing | Your account and receipt details have been checked and approved. We’re ready to send your claim to the store. We send invoices for VAT refund claims to stores two (2) times a month on Tuesdays. |

| Waiting for payment from shop | We’ve sent your claim to the store for processing. Most stores process claims within 30 business days. You can find your expected payment date in your account. |

| Paid by shop | The store has processed your claim and transferred the VAT to vatfree.com. You can now request payment. |

| Payout requested | We’ve received your payment request. The amount will be transferred to your account during our first upcoming payment-run. You’ll receive a notification via email when payment has been transferred to your account. |

| Fully paid | We’ve transferred your refund amount to your account. You should have received an email from us to let you know that we've paid. |

Depreciated | If your receipt has the status 'depreciated' this means your claim has expired in our system and can no longer be paid (due to bookkeeping and accounting reasons). Claims expire in our system if you do not request payment within 2 years after the store has processed your claim. Please keep a close eye on your email inbox and the receipt status in your account. As soon as a store has processed your claim we let you know automatically via email (and in your account) that you can log in to request payment. Please request payment on time so your claim does not expire. |

Yes. Officially, purchased items must be presented to customs in their original packaging. If, for whatever reason, you need to use your purchases before leaving the EU (like a new phone or laptop) please bring the original packaging with you to customs.

We advise you to always leave price tags on clothing and to leave food items in their original packaging until after you have arrived back in your non-EU homecountry.

Germany 🇩🇪 /Standard VAT rate: 19%

Low VAT rate: 7% on some foods, books (excluding books whose content is harmful to minors), e-books, audiobooks, newspapers and periodicals (except those containing content harmful to minors and/or more than 50% advertising)

Minimum spend amount: EUR 50.01 in the same store on the same day

Time limit to export: before the end of the 3rd month, after the month of purchase

Ask in the store: an invoice, Tax-Free form, or Tax-Free receipt: showing your name, non-EU address and passport number.

Required for Germany Customs:

Passport

If you have an EU passport; other proof of residence outside the EU

Boarding pass

Purchased items

Standard VAT rate: 20%

Low VAT rate: 10% on some foods, some works of art, collectors items

Low VAT rate: 5.5% on medicines, some pharmaceutical goods, books, magazines

Minimum spend amount: EUR 100 in the same store on the same day

Time limit to export: before the end of the 3rd month, after the month of purchase

Ask in the store: in France, you must receive a Tax-Free form from the store. If you don’t receive a Tax-Free form in-store, you can’t get back the VAT. Your VAT is refunded by the Tax-Free company visible on the form.

Required for French Customs:

French stores: Tax-Free form issued by the French store (don't forget to ask the store when purchasing your goods)

Stores from other EU countries: Any receipt/invoice showing store address, total amount, VAT amount, description of goods. We advise you to print a Tax-Free form as some customs departments in France do not want to provide proof of export without it.

Passport

If you have an EU passport; other proof of residence outside the EU

Boarding pass

Purchased items

Purchase invoice/receipt

If the Customs machine is not working or you’re departing from another EU country, go to a manual Customs desk for an export stamp. You can ask an airport employee to point you in the right direction.

Standard VAT rate: 21%

Low VAT rate: 6% - food and books

Minimum spend amount: EUR 125,01 in the same store on the same day

Time limit to export: before the end of the 3rd month, after the month of purchase

Ask in the store: an invoice, Tax-Free receipt or Tax-Free form showing your name, non-EU address and passport number. If the store can't provide this, you can download and print a standard Tax-Free form yourself to add to the purchase documents from the store.

Required for Belgian Customs:

Passport

If you have an EU passport; other proof of residence outside the EU

Boarding pass

Purchased items

Standard VAT rate: 21%

Low VAT rate: 10% on food and some optical products

Low VAT rate: 4% on medicines, pharmaceutical goods, books, magazines

Minimum spend amount: EUR 0 - no minimum

Time limit to export: before the end of the 3rd month, after the month of purchase

Ask in the store: in Spain, when you go shopping, you must bring your passport to get a DIVA Tax-Free form from the store. If you don’t receive a Tax-Free from in-store, you can’t get back the VAT. Your VAT is refunded by the Tax-Free company visible on the form.

Required for Spanish Customs:

Spanish stores: DIVA Tax-Free form issued by the store (don't forget to ask for the formwhen purchasing your goods)

Stores from other EU countries: standard tax-free form

Any other purchase receipts and documents received from the stores

Passport